Oakmark Fund (OARMX) Technology Sector Skill

In general, even fund managers that generate persistently positive active returns are rarely skilled across the board. They have stronger skills or employ stronger analysts in some sectors than in others.

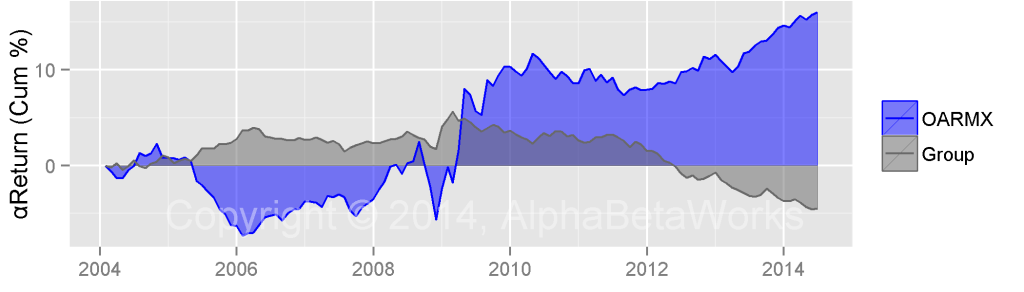

The Oakmark Fund (OARMX) is no different. Over the past 10 years, it generated ~15% from security selection (stock picking):

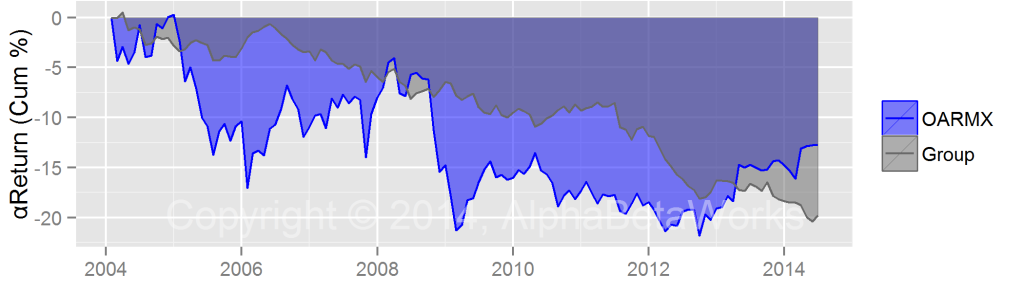

Over the same period, Oakmark Fund lost ~12% from technology sector security selection:

Technology investing is notoriously hard for value investors and mutual funds in general. Even with survivor bias, technology portfolios of medium turnover U.S. mutual funds with 10 years of history have under-performed by ~20%.