The Trend Towards U.S. Hedge Fund Passivity

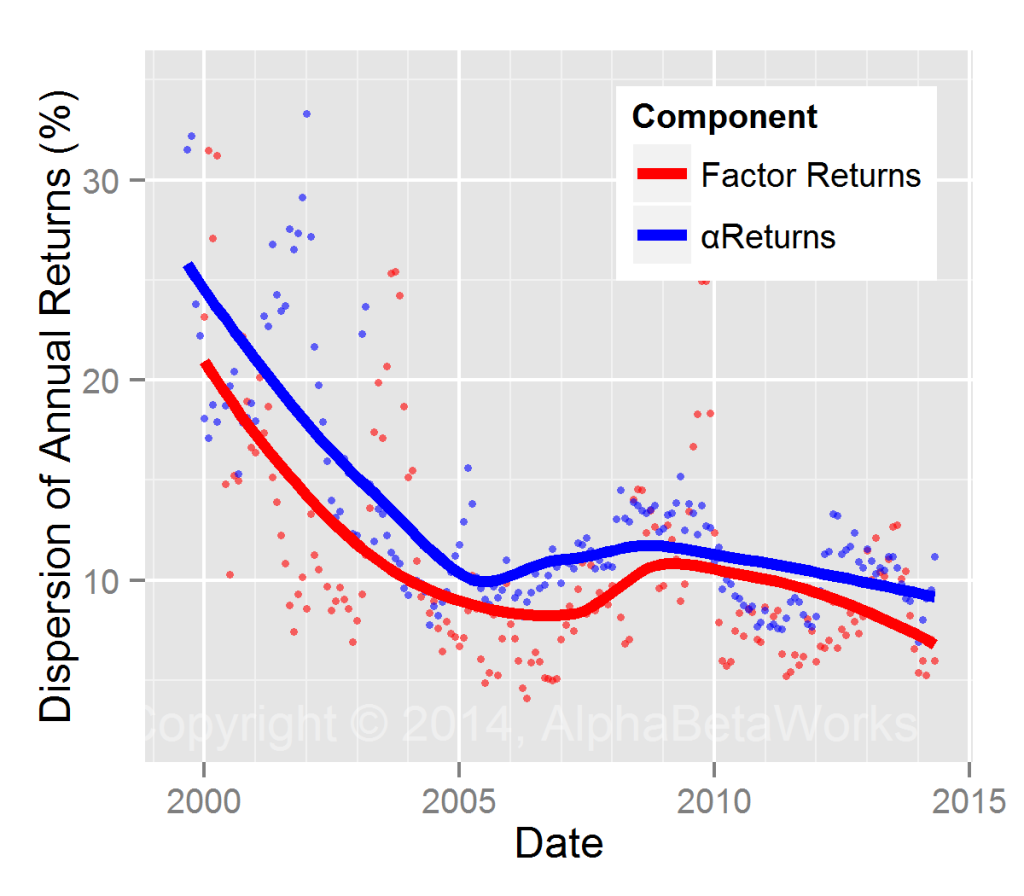

We charted the historical cross sectional standard deviation of factor (systematic) and α (security selection) returns for U.S. hedge funds:

A surprising finding is that, even in midst of the 2008-2009 market volatility spike, the long positions of U.S. hedge funds were less differentiated from each other that they had been in the relatively lower-volatility regime of 2003-2004.