Risk models and portfolio analysis tools often assume that all foreign securities have local currency exposure (beta) of one, under the convenient belief that reference currency performance due to local currency changes is simply local currency appreciation.

Reality is rarely this convenient. This standard approach misrepresents the true currency risk of most foreign investments. For example, an exporter’s margins will expand when its domestic currency depreciates; thus its local currency value will increase as the currency declines. Importers will act in the opposite fashion. Meanwhile, security valuations in emerging markets are vulnerable to external capital flows, amplifying currency risk.

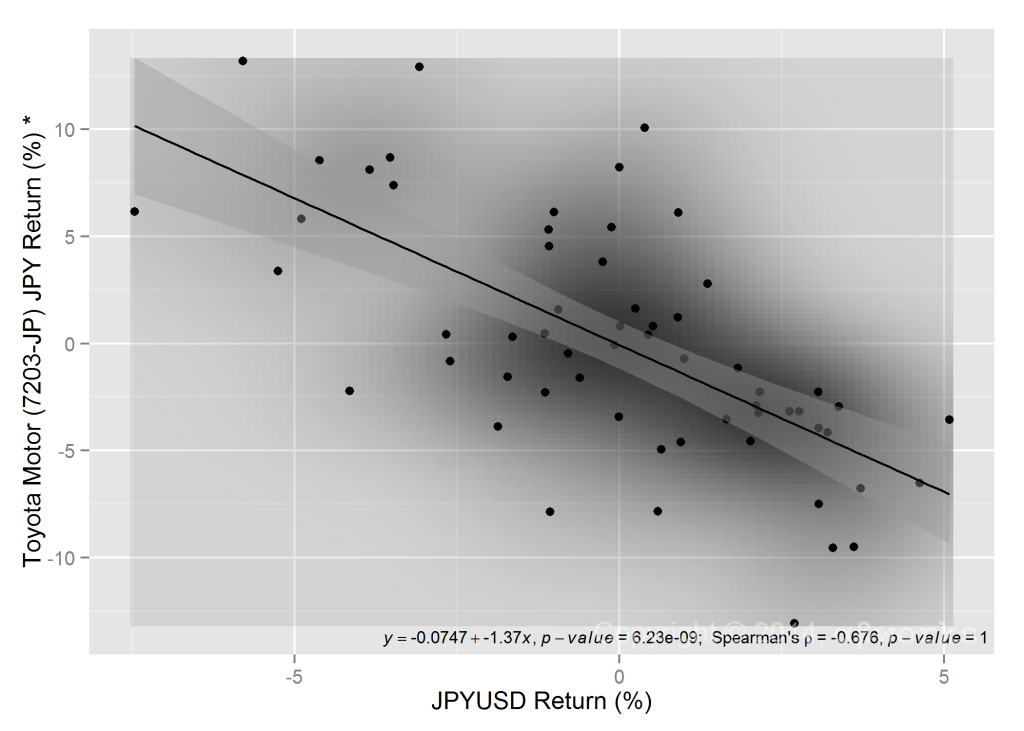

The following figure illustrates the relationship between the JPYUSD exchange rate and the local (JPY) share price for Toyota – an example representative of other Japanese exporters:

When Toyota Motor Corporation sells cars outside of Japan, it receives dollars from U.S. sales, Euros for European sales, etc. Meanwhile, some of the costs of these sales are incurred in Japan. As JPY declines relative to USD or EUR, costs decline relative to sales and margins expand. As margins expand and profits increase, Toyota’s shares appreciate. The result is a negative relationship between Toyota’s share price and JPY.

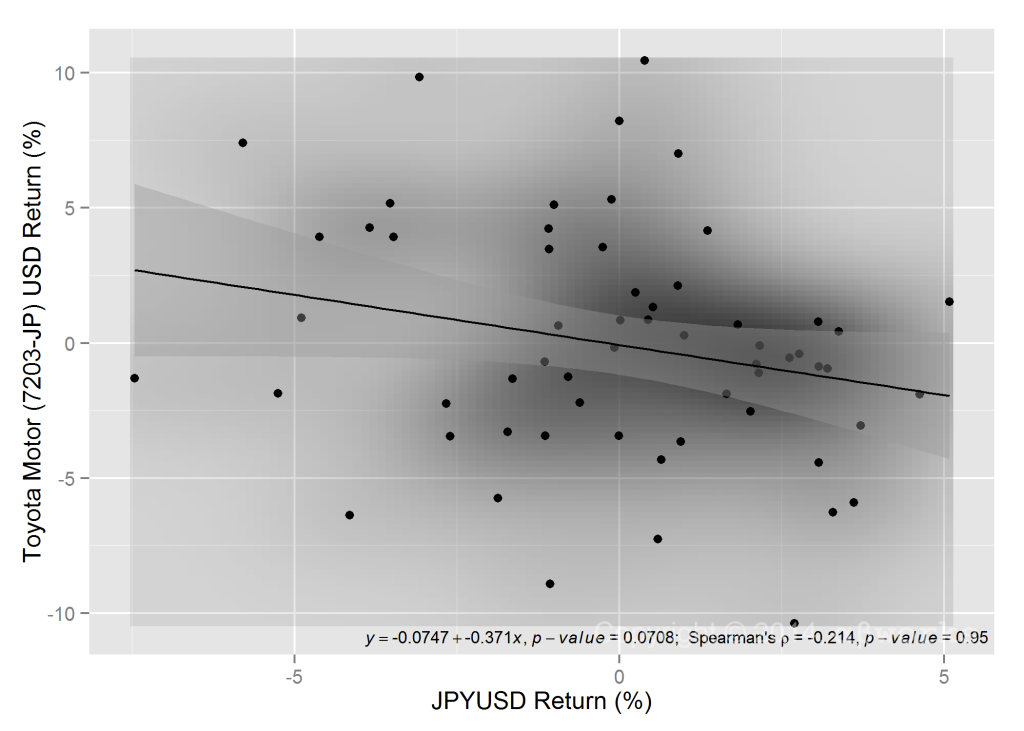

It is tempting to think that a U.S. investor who holds Toyota un-hedged has long JPY exposure. In reality, this investor is short JPY. The local currency beta of Toyota more than offsets the JPYUSD FX risk. $1 Invested in Toyota, un-hedged, creates approximately $0.37 short JPY exposure:

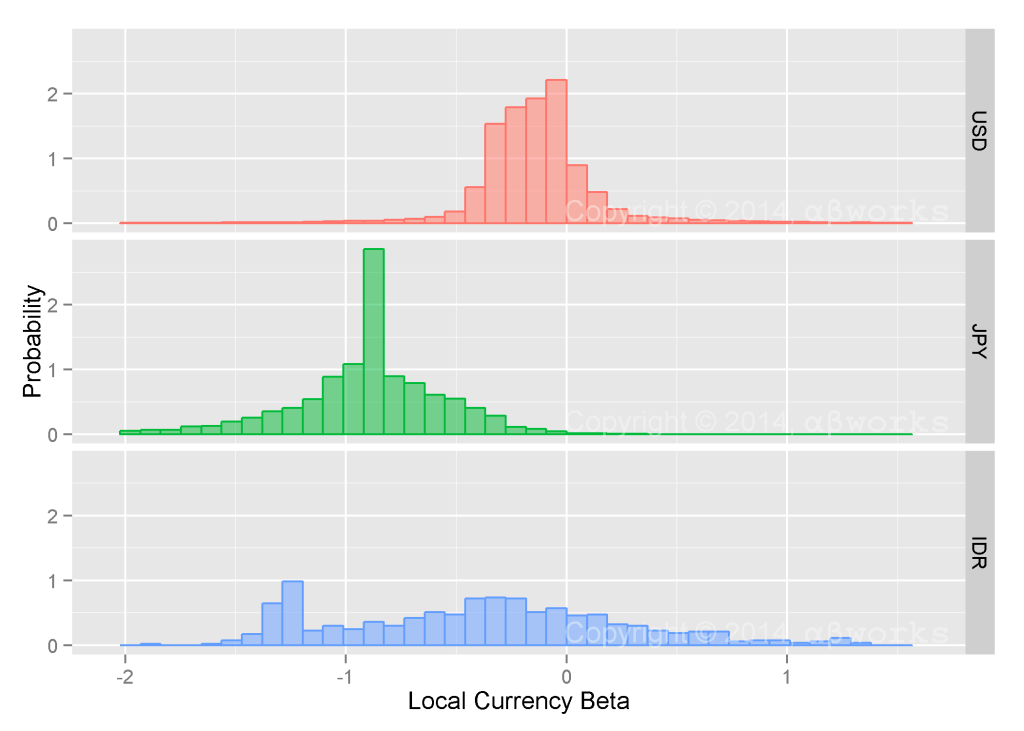

In general, local currency betas vary among and within markets. Simple (and widely used) estimates of currency risk can thus be misleading:

Currency risk can be especially complex in emerging markets that are broadly dependent on external capital flows, yet have a number of exporters that benefit from currency declines.

The AlphaBetaWorks World Equity Risk Model encompasses local currency beta and the translation from local to reference currency. This compound process provides an edge to most international investors and was valuable, for example, to U.S. investors looking to be long Japanese equities in 2012 and 2013.