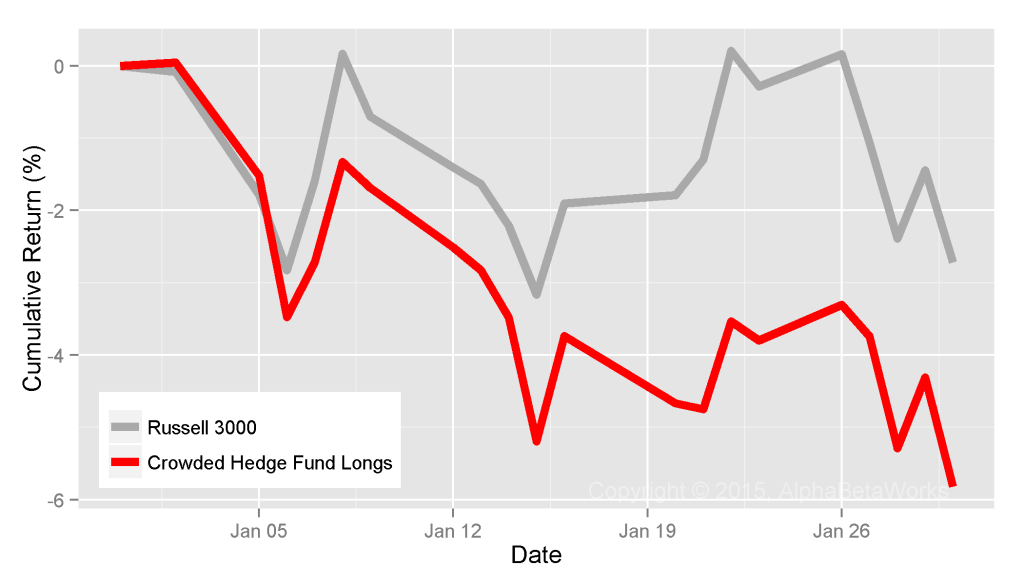

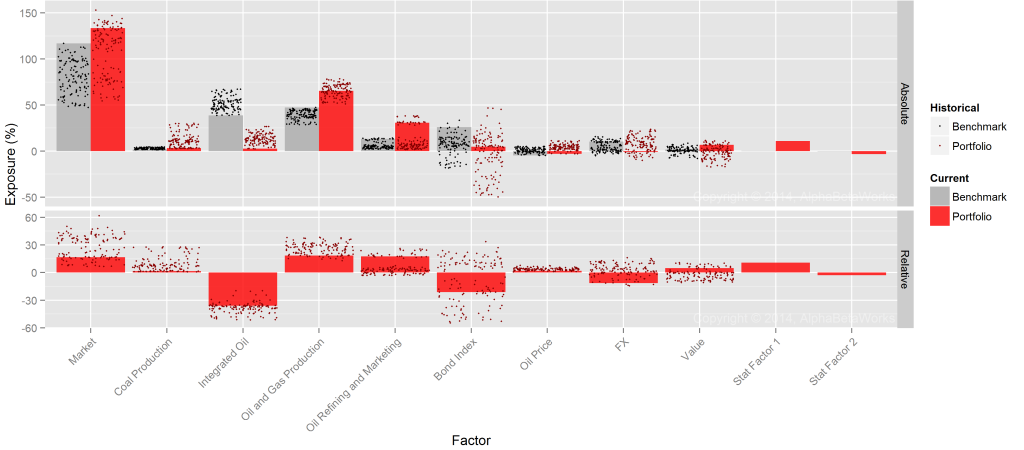

The single largest bet hedge fund long portfolios were making in Q1 2015 was on the U.S. market (high beta). While the bet is exceptionally large, it is not predictive of market direction. Allocators should pay attention to this risk aggregation.

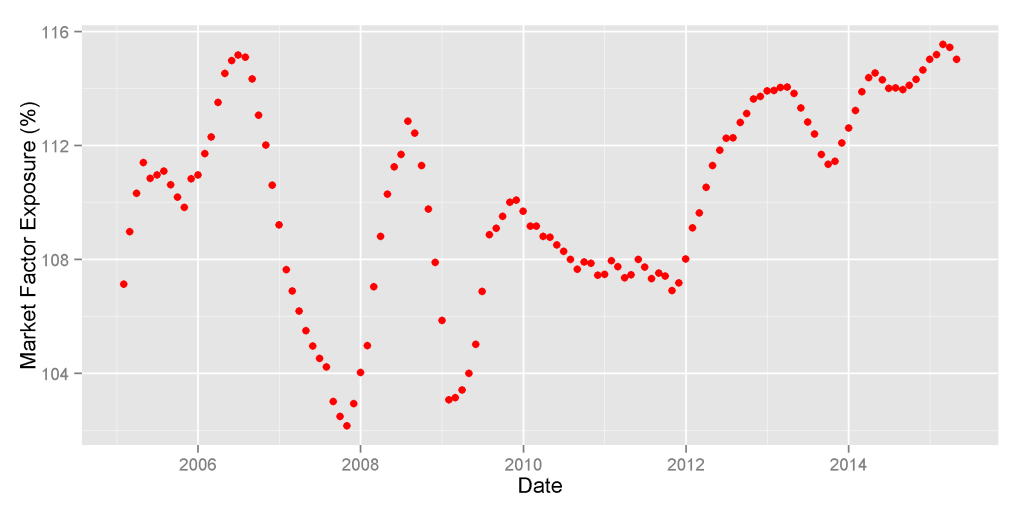

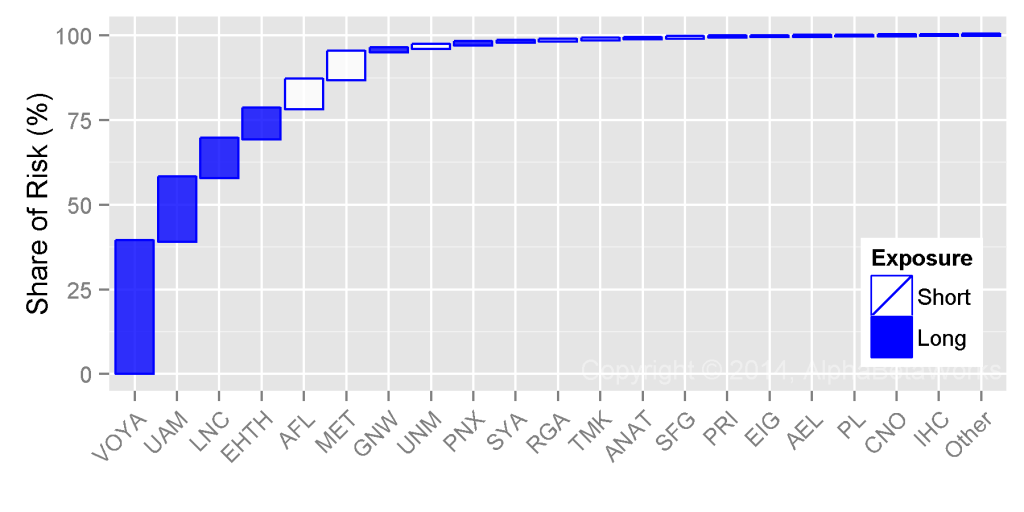

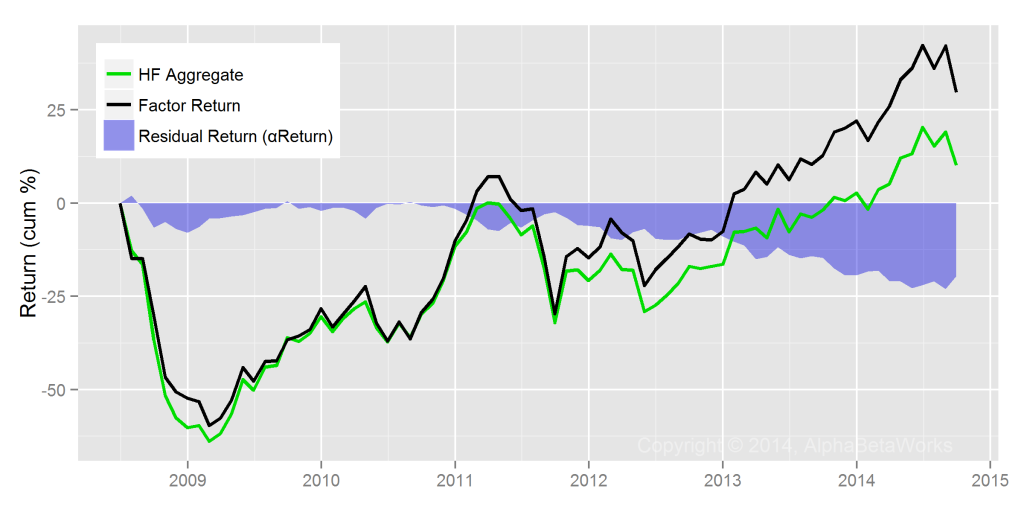

At the end of Q1 2015, high market factor exposure (high beta) was the primary source of U.S. hedge funds’ long portfolio crowding. HF Aggregate, a portfolio consisting of popular long U.S. equity holdings of all hedge funds tractable from quarterly filings, had approximately 115% U.S. market factor exposure (1.15 U.S. market beta). This exposure was at 10-year highs – the level last seen in mid-2006:

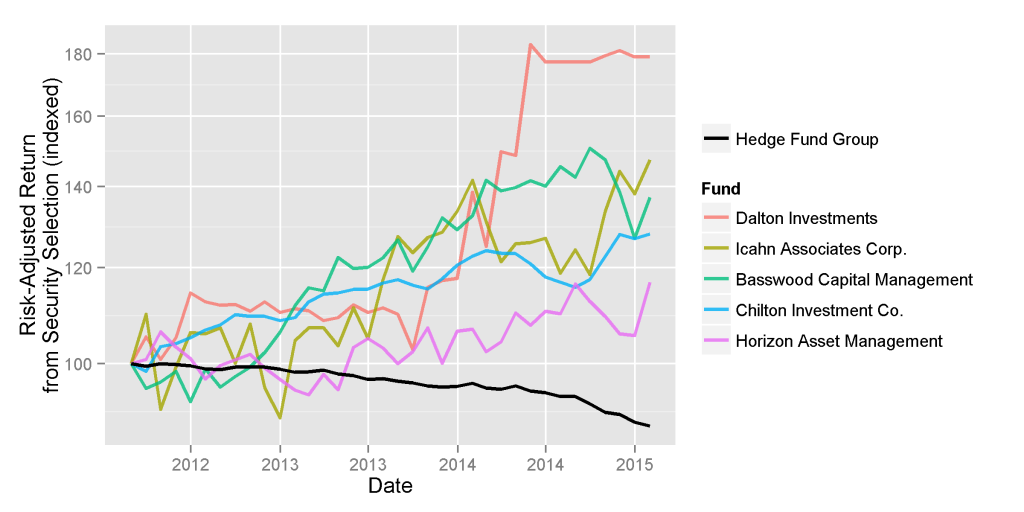

Our work on hedge fund crowding has so far not addressed hedge fund factor timing and hedge fund U.S. market timing specifically. We dive into this performance here.

The AlphaBetaWorks Performance Analytics Platform evaluates market timing skills and performance using two related tests:

- Statistical test for the relationship between factor exposure and subsequent factor returns,

- Statistical test for the size and consistency of returns generated by varying factor exposures.

Hedge Fund Market Exposure and Market Return

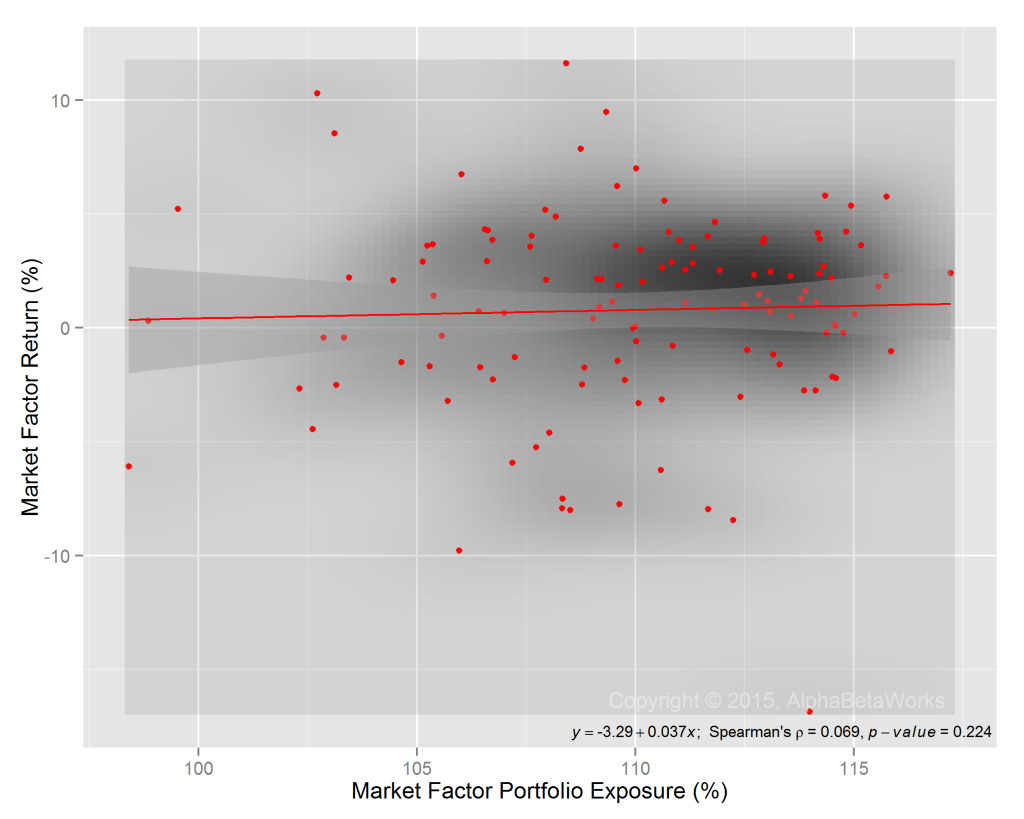

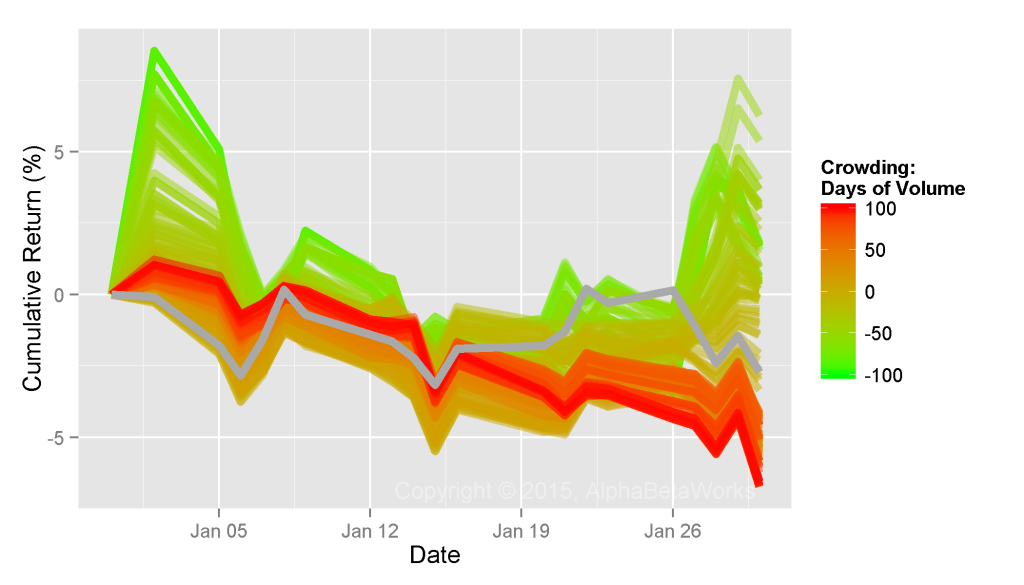

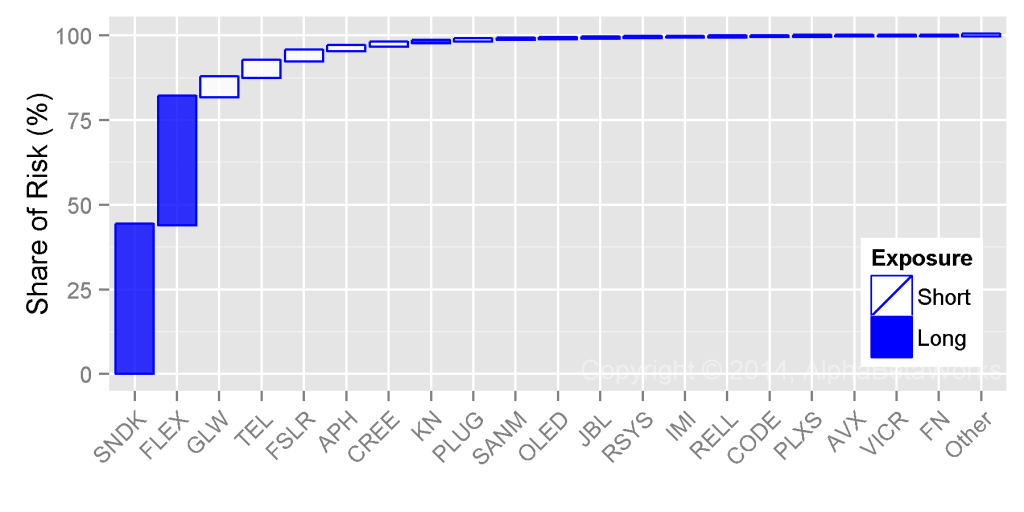

We calculated the Spearman’s rank correlation coefficient of HF Aggregate’s market exposure and subsequent market return and tested it for significance. The chart below illustrates the correlation between the two series and the test results:

The chart shows that there is a positive relationship between HF Aggregate’s U.S. market exposure and subsequent U.S. market return, but it is weak and statistically insignificant. In other words, hedge funds’ variation in U.S. market exposure has done little to help their performance.

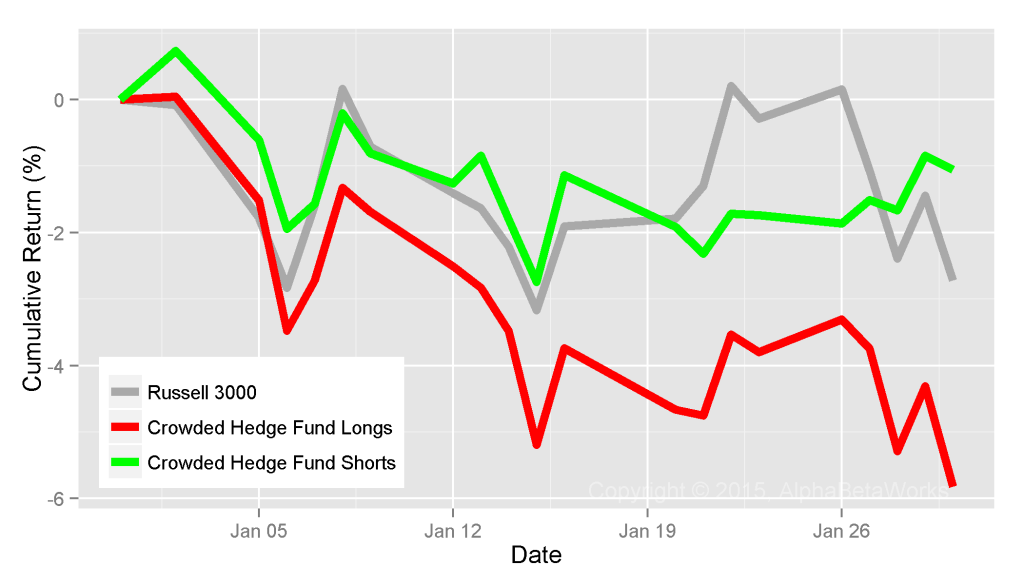

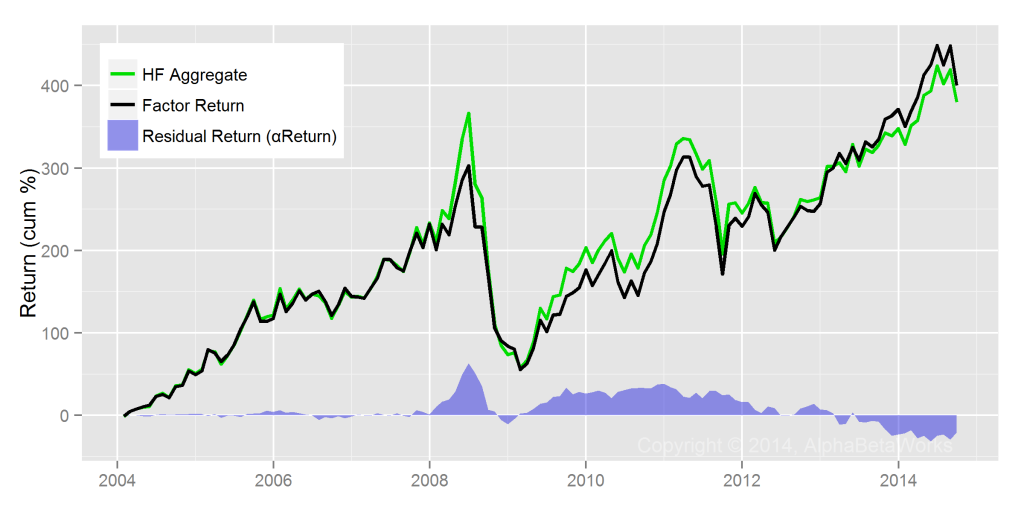

Hedge Fund U.S. Market Timing Returns

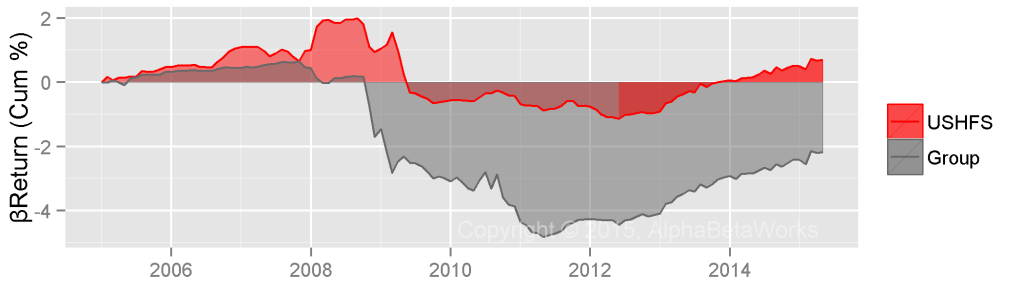

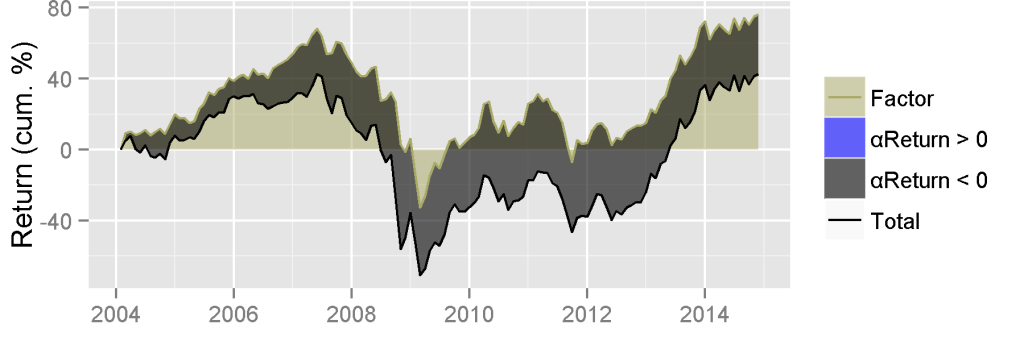

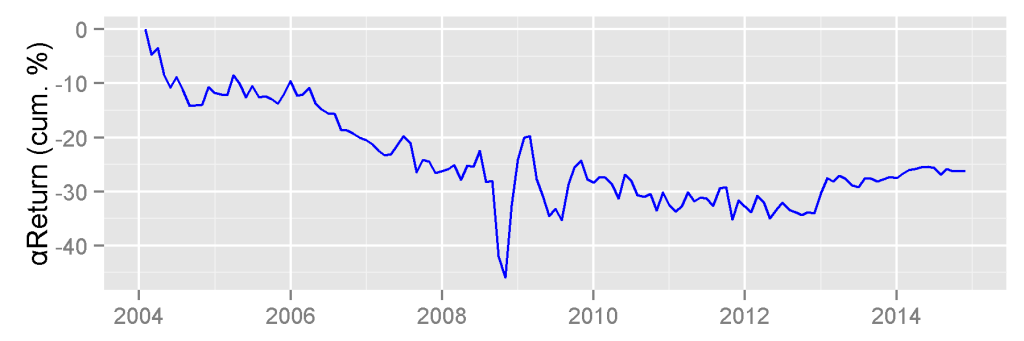

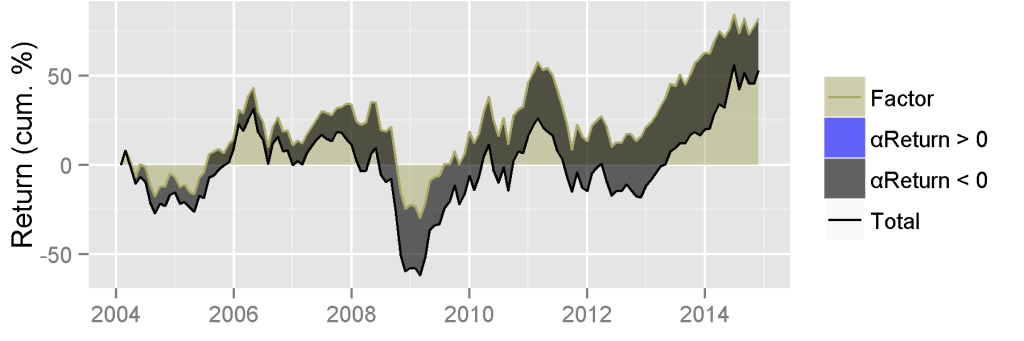

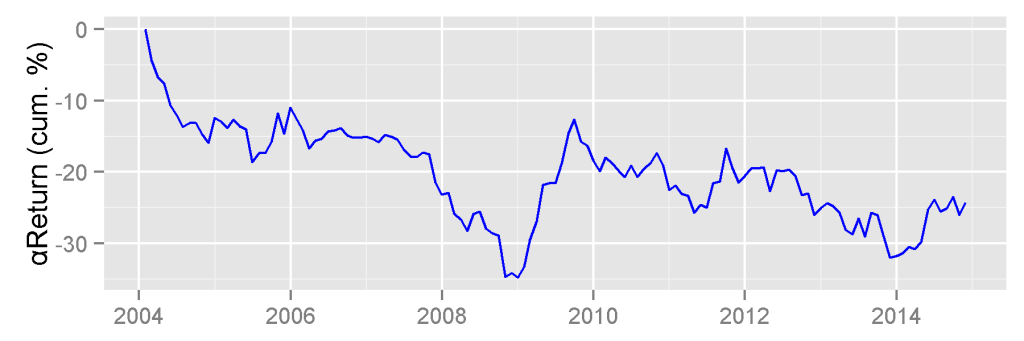

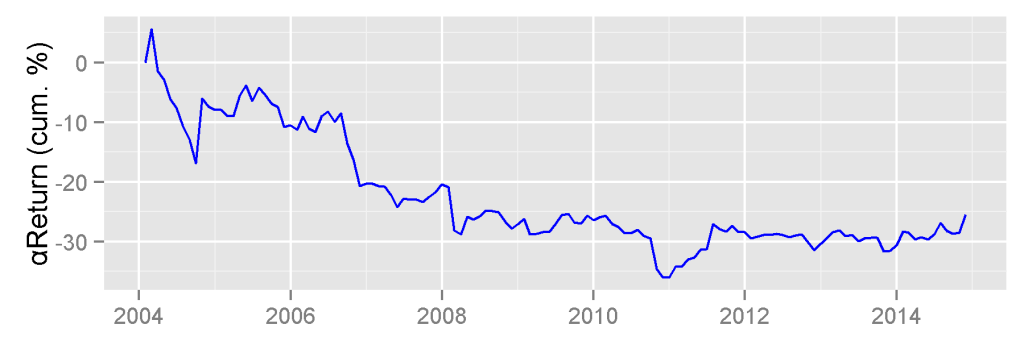

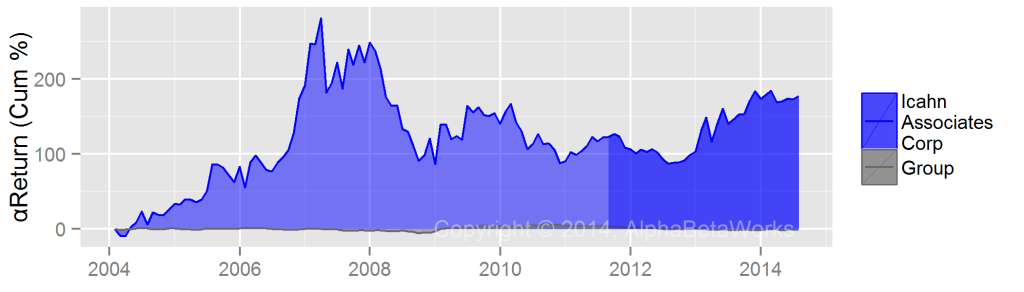

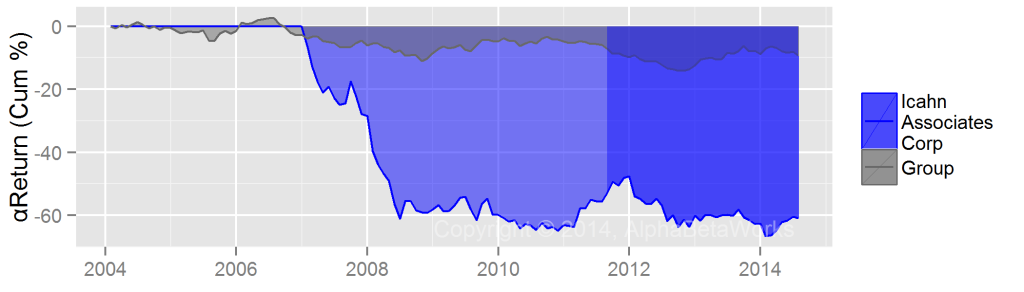

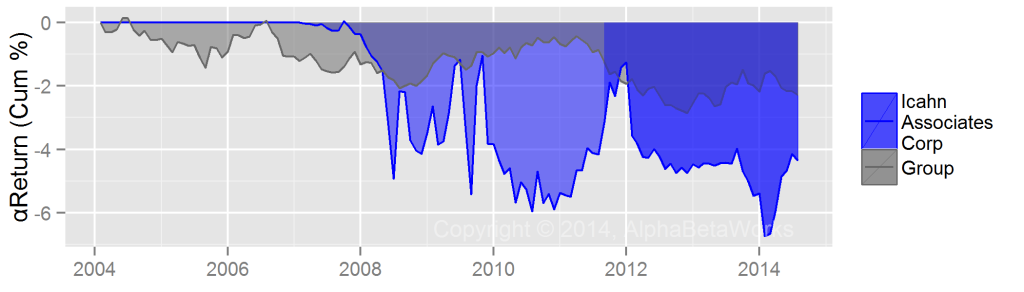

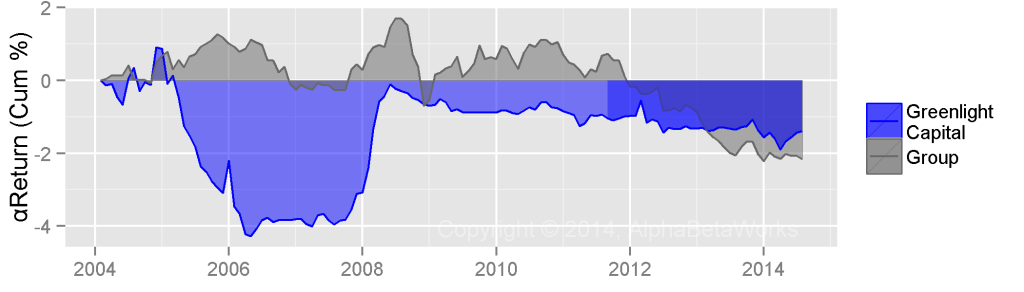

Over the past 10 years, HF Aggregate (USHFS in red) made approximately 1% more than it would have with constant factor exposures, as illustrated below. The performance of HF Aggregate is compared to all tractable 13F filers (Group in gray). The AlphaBetaWorks Performance Analytics Platform identifies this performance due to U.S. market factor timing as U.S. market βReturn:

The performance impact of this variation in beta within U.S. hedge fund long portfolios is also minor. However, the group of all 13F filers was a poor market timer, particularly during the volatility of 2008-2009. During the crisis, non-filers were the smart money and took advantage of U.S. market volatility, at the expense of 13F filers. 13F filers were a contrarian indicator.

Summary

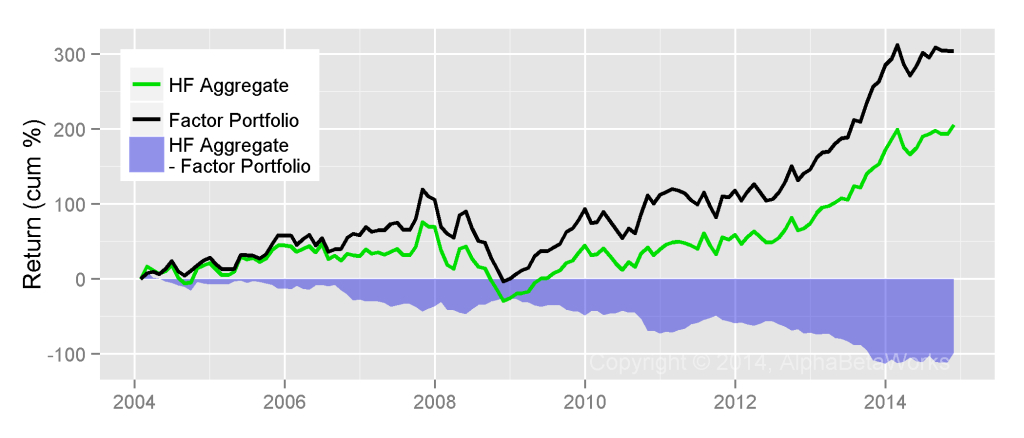

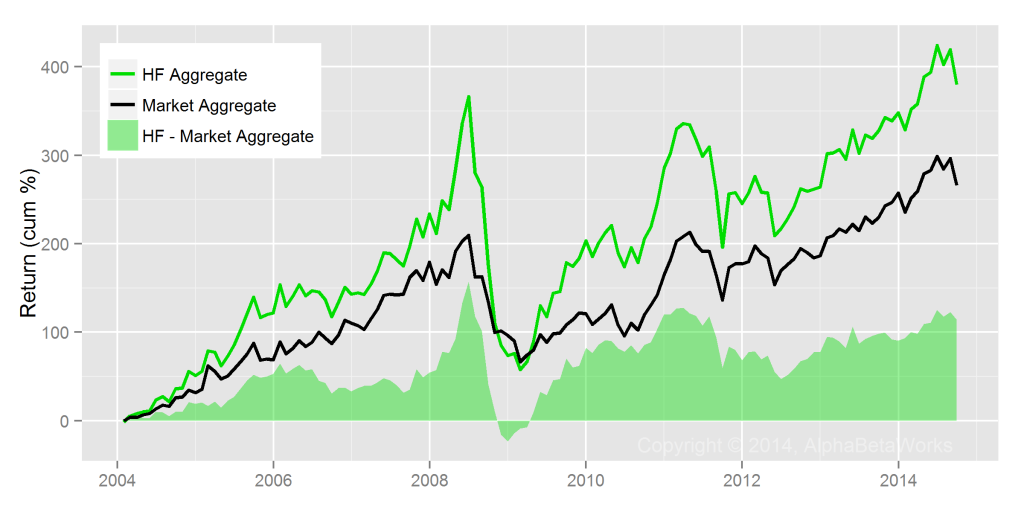

- Hedge fund long equity portfolios consistently take 5-15% more market risk than S&P500 and other broad market benchmarks.

- There has been no statistically significant relationship between U.S. market exposure (market beta) of U.S. hedge funds’ long portfolios and subsequent market return.

- The high market factor exposure of U.S. hedge funds’ long portfolios is not predictive of subsequent market returns.

- The broader group of all 13F filers generated significant negative returns by varying market exposure, particularly during the 2008-2009 volatility.

The information herein is not represented or warranted to be accurate, correct, complete or timely.

Past performance is no guarantee of future results.

Copyright © 2012-2015, AlphaBetaWorks, a division of Alpha Beta Analytics, LLC. All rights reserved.

Content may not be republished without express written consent.