As we discussed in an earlier article, excellent investors are not equally proficient in all areas. While Greenlight’s overall stock picking performance is stellar, it does not extend to all sectors. Its picks are excellent in technology and subpar in healthcare, for instance. Results are mixed in energy.

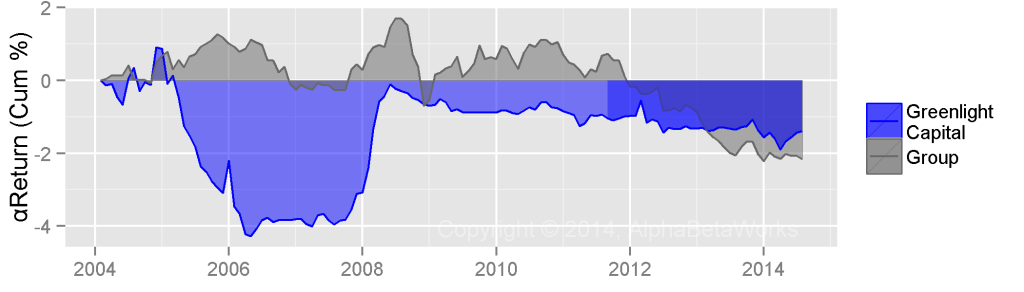

The following is a chart of the estimated security selection (stock picking) return due to the energy positions of Greenlight Capital. This is Greenlight’s αReturn – the estimated annual percentage return a fund would have generated in a flat market. The chart covers long equity (13F) portfolio:

Over the period, Greenlight’s energy positions underperformed a passive portfolio with similar systematic risk by approximately 1%.

Talented investors’ skills are specific. Greenlight’s followers should be careful before investing in an energy stock based solely on Greenlight’s involvement.