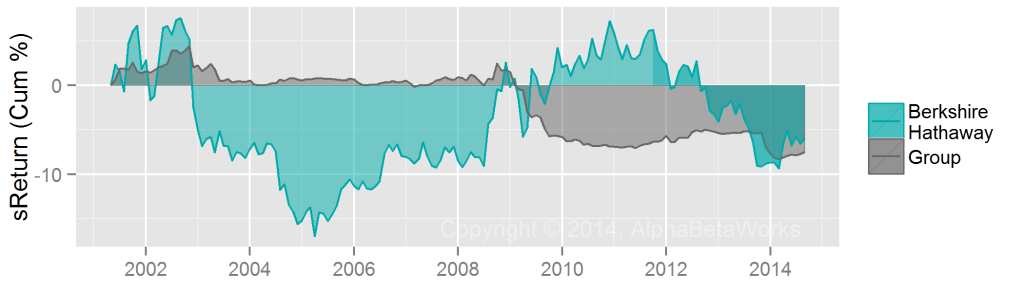

Generally, Berkshire Hathaway’s largest positions are not its best ones. If Berkshire sized all positions equally for the past 12 years, the risk adjusted return of long equity portfolio would have been approximately 5% higher:

Position sizing cost portfolio approximately 10% over the past three years.

Berkshire’s managers appear to have made some of their largest positions things they can scale, rather than things they want to scale. Given the size of Berkshire’s portfolio, it is remarkable the sizing return is not worse.

Investors who follow skilled managers tend to assume their top positions are their best ideas. This is often wrong.