iShares Core High Dividend ETF (HDV) is a low-risk fund that has consistently delivered positive risk-adjusted return.

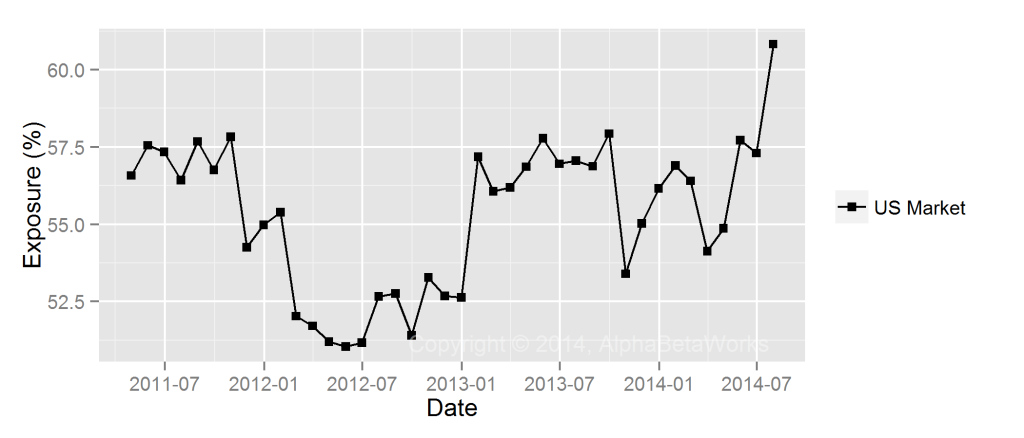

iShares Core High Dividend ETF (HDV) – Historical Beta

U.S. Market exposure (beta) of the fund has varied in the narrow window between 0.52 and 0.60:

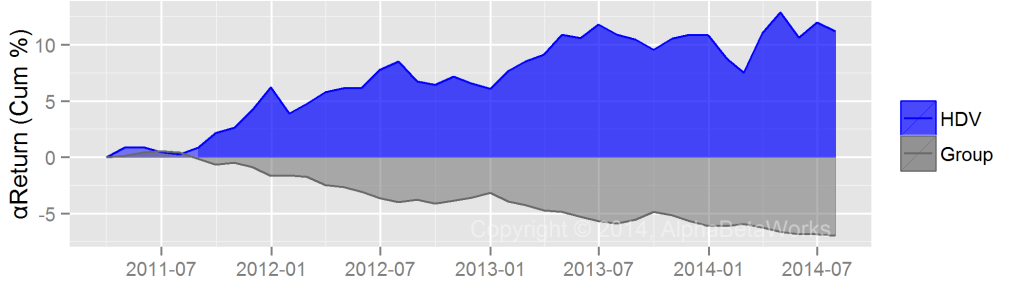

iShares Core High Dividend ETF (HDV) – Historical Alpha

The fund has consistently generated positive risk-adjusted return from security selection (αReturn):

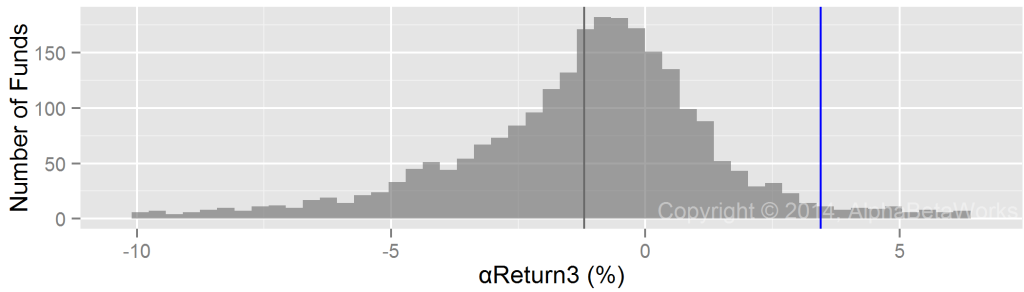

This αReturn exceeds the results of 95% of U.S. mutual funds with medium and lower portfolio turnover rates: