Pershing Square’s Finance Sector Security Selection Performance

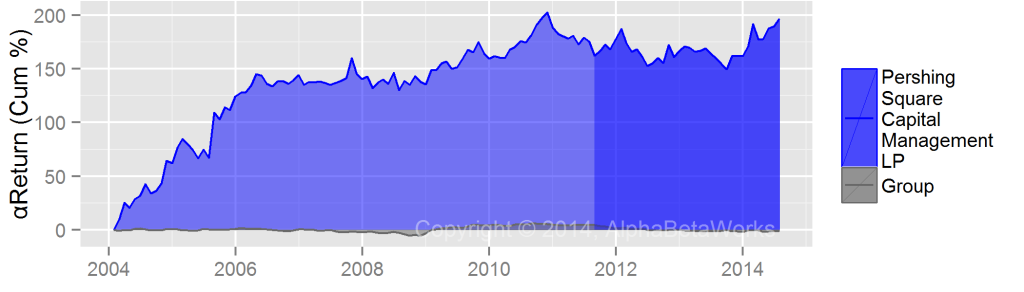

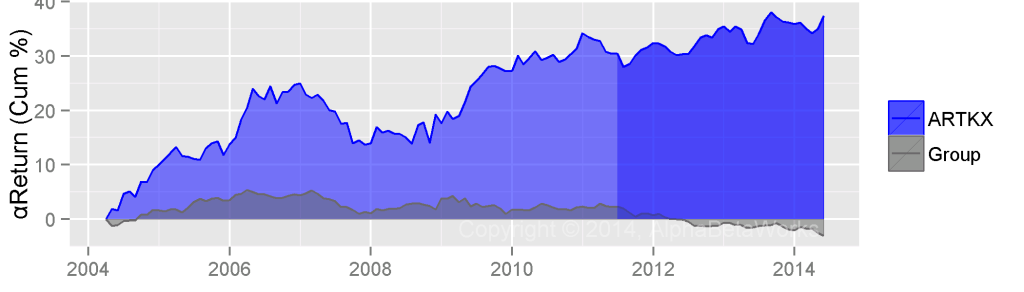

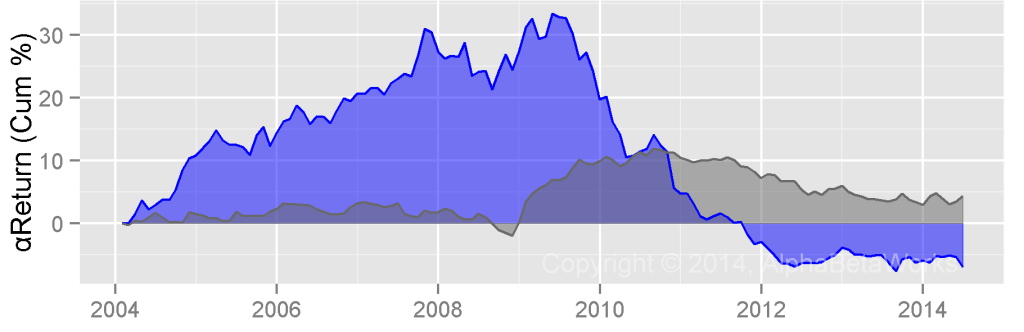

Pershing square has a phenomenal track record of stock picking. Over the past 10 years, it has generated approximately 200% risk-adjusted return from security selection in its long (13F) portfolio. If market were flat for the past 10 years, the portfolio would have gained approximately 200%. We call this risk-adjusted return αReturn:

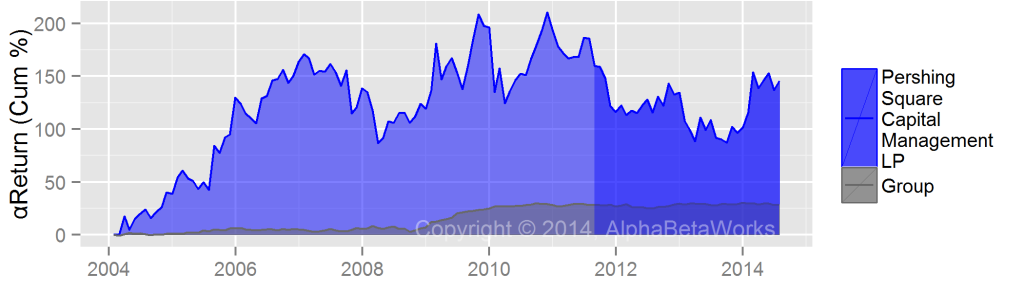

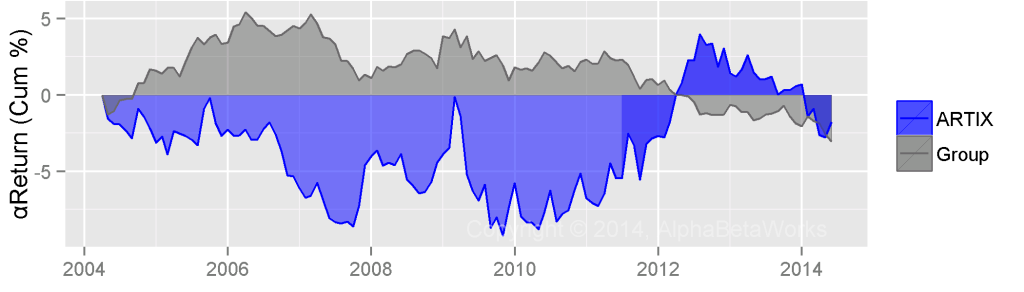

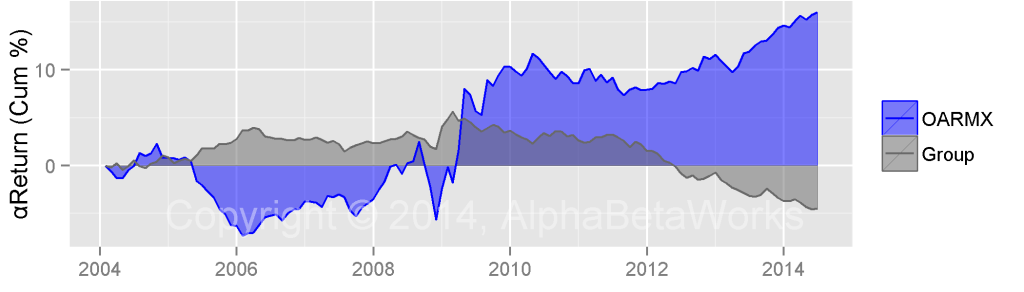

The performance of the firm’s finance sector stock picks is almost as impressive, just slightly less strong than the overall portfolio and less consistent. Over the past 10 years Pershing Square’s long finance sector portfolio generated approximately 150% risk-adjusted return from stock picking (αReturn):

This is encouraging for the investors in Fannie Mae (FNMA) and Freddie Mac (FMCC). Bill Ackman has invested in the companies and sees them as the most interesting opportunity since General Growth Properties (GGP) in 2008.