Greenlight’s Long Equity Position Sizing

Greenlight’s top positions generally aren’t its best ones. It is common to assume that the top positions of skilled investors are their best ideas, but this is not always the case. If Greenlight sized all positions equally for the past 10 years, the risk adjusted return of long portfolio would have been approximately 20% higher.

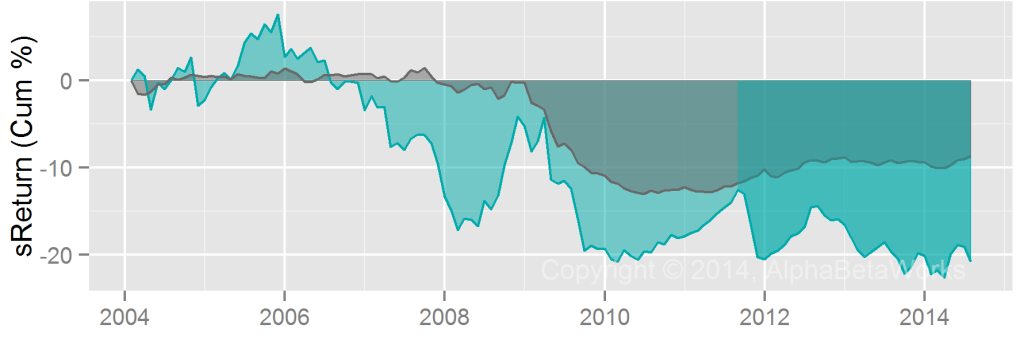

We can’t know for sure whether Greenlight Capital can’t identify their best stock picks, or can’t scale them. What we do know is that the risk-adjusted return of their average position is higher than the risk-adjusted return of their top position. AlphaBetaWorks defines this return – the difference in stock picking (αReturn) between the actual portfolio and equal-size portfolio – as sReturn. For Greenlight, it is negative:

When a successful manager’s fund grows, they may have trouble scaling their best picks. Their largest positions become the names they can, rather than prefer to, buy the most of.