Energy investments have struggled in recent months. Crowded hedge fund energy bets have done especially poorly. In this piece, we explore the overall hedge fund energy performance and the results of the top stock pickers in the Oil and Gas Production, Integrated Oil, and Oilfield Services Sectors.

Top Energy Hedge Funds

Risk-adjusted return from security selection isolates managers’ stock picking performance and identifies skill. AlphaBetaWorks defines αReturn as a metric of security selection performance – the estimated annual percentage return a fund would have generated in a flat market. This is also the outperformance relative to a passive portfolio with the same market (factor, systematic) risk.

The hedge fund industry has a poor record in the Energy Sector. Over the past 10 years, investors would have made approximately 20% more holding an ETF portfolio with similar market (factor) risk. If markets had been flat for the past 10 years, the average hedge fund long energy portfolio would have declined by approximately 20%.

Over the past three years, the peer group of all medium turnover hedge funds lost approximately 12% picking long energy stocks. On average, if the funds had simply invested in a portfolio of ETFs with the same risk, they would have made 12% more on their energy book. Half of these losses came in 2014:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Year | |

| 2012 | -1.08 | -0.29 | -0.14 | 0.48 | -0.15 | -0.28 | -0.54 | -0.16 | 0.44 | 0.10 | -0.08 | -0.38 | -2.06 |

| 2013 | -0.63 | 0.12 | 0.35 | -0.74 | -0.33 | -0.75 | 0.14 | -0.45 | -0.32 | -0.58 | -0.26 | 0.18 | -3.22 |

| 2014 | 0.54 | -0.89 | -0.23 | 0.64 | -0.90 | -0.35 | -0.74 | -0.01 | -1.34 | -1.58 | -0.45 | -1.42 | -6.55 |

| 2015 | -0.77 | -0.77 |

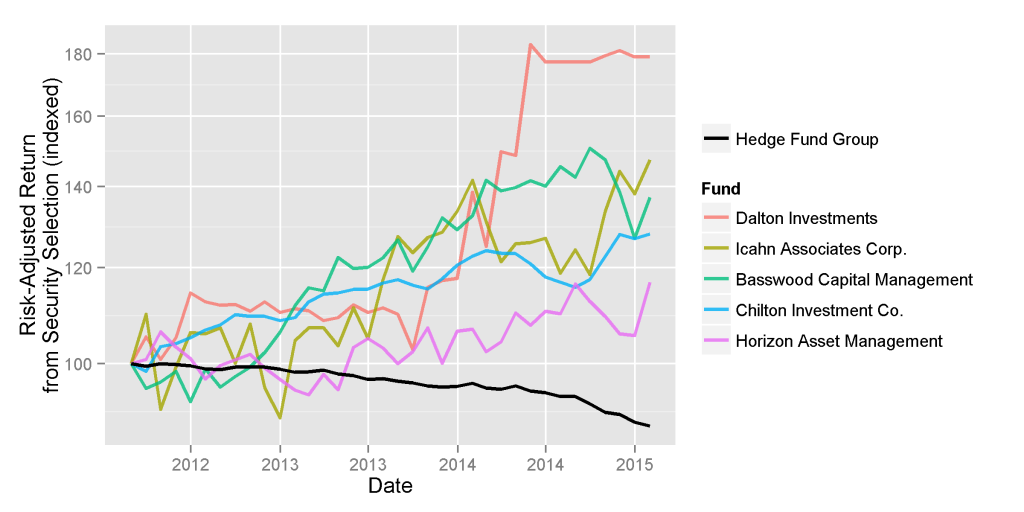

In the following chart we compare the energy αReturns of the top stock pickers to the returns of the group. The top stock pickers’ energy books made 20-80% more than they would have passively:

| Fund | Energy Sector Security Selection αReturn Long Positions |

| Dalton Investments LLC | 79.00 |

| Icahn Associates Corp. | 47.31 |

| Basswood Capital Management LLC | 37.14 |

| Chilton Investment Co. LLC | 27.92 |

| Horizon Asset Management LLC | 16.74 |

Top Energy Hedge Funds’ Trades

Since stock picking skills are persistent and predictive, the trades and positions of the best and worst stock pickers are predictive of future stock performance. Investors should pay attention to the bets of the top managers.

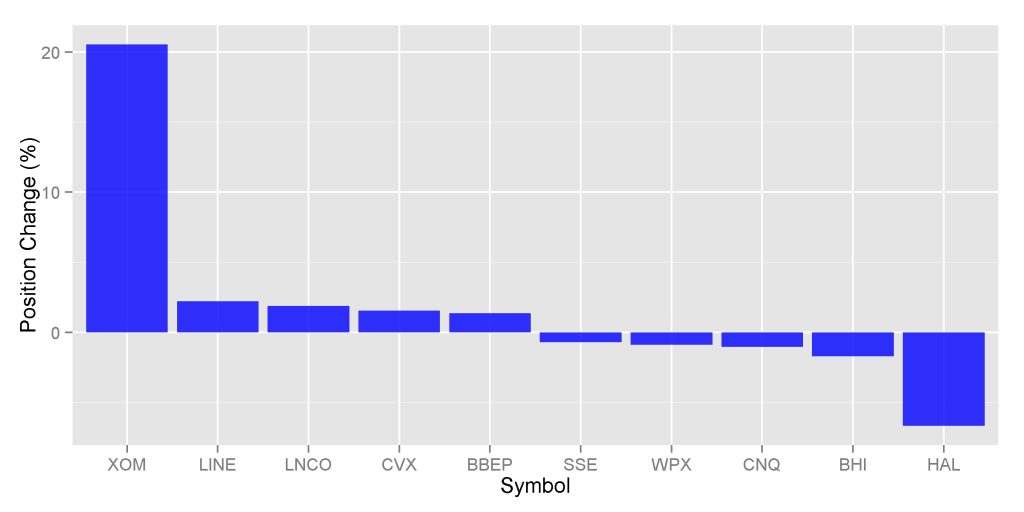

We averaged the energy positions of these top performers. The following were their largest position increases and decreases during Q4 2014:

| Symbol | Name | Position Change (%) |

| XOM | Exxon Mobil Corporation | 20.54 |

| LINE | Linn Energy, LLC | 2.22 |

| LNCO | LinnCo. LLC | 1.89 |

| CVX | Chevron Corporation | 1.55 |

| BBEP | BreitBurn Energy Partners L.P. | 1.38 |

| SSE | Seventy Seven Energy Inc | -0.71 |

| WPX | WPX Energy, Inc. Class A | -0.88 |

| CNQ | Canadian Natural Resources Limited | -1.04 |

| BHI | Baker Hughes Incorporated | -1.73 |

| HAL | Halliburton Company | -6.68 |

Top Energy Hedge Funds’ Positions

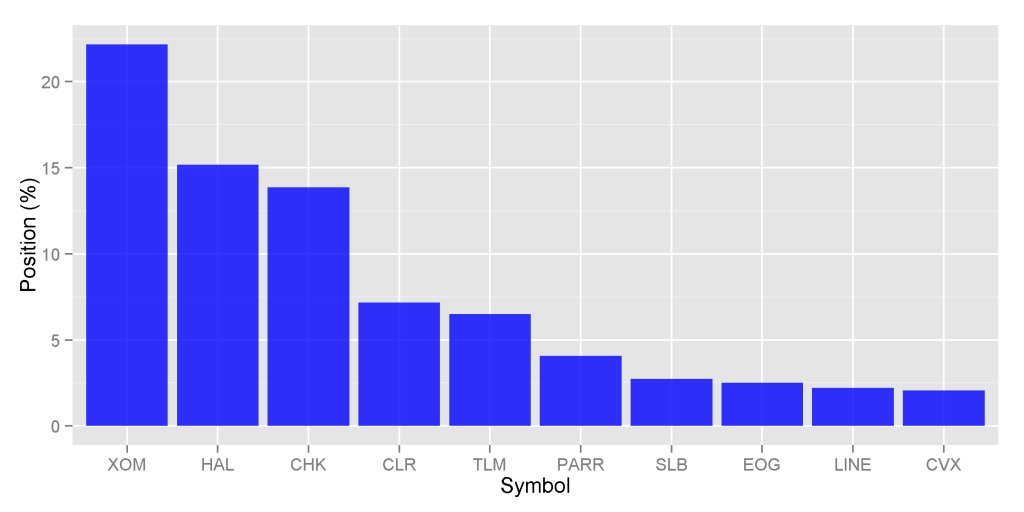

At 12/31/2014, the top performers’ average portfolio consisted of the following positions:

| Symbol | Name | Position (%) |

| XOM | Exxon Mobil Corporation | 22.16 |

| HAL | Halliburton Company | 15.19 |

| CHK | Chesapeake Energy Corporation | 13.86 |

| CLR | Continental Resources, Inc. | 7.17 |

| TLM | Talisman Energy Inc. | 6.51 |

| PARR | Par Petroleum Corporation | 4.08 |

| SLB | Schlumberger NV | 2.74 |

| EOG | EOG Resources, Inc. | 2.52 |

| LINE | Linn Energy, LLC | 2.22 |

| CVX | Chevron Corporation | 2.07 |

Conclusions

- The hedge fund industry has a poor track record selecting long energy stocks. A typical fund would have done better investing passively, and outside investors would do well to short crowded picks in the sector.

- Despite the poor industry performance, some funds do have excellent energy stock picking records. These records are persistent and predictive.

- In recent months, the top energy funds have increased their XOM position and cut HAL. HAL remained a top bet, along with XOM and CHK.