In an earlier post, we discussed the largest bets hedge fund long portfolios were making in Q1 2015. The third largest was on the Industrials Factor. This is the risk specific to the industrials sector after controlling for market exposure. It captures capital allocation to industrials and sensitivity (beta) to the sector. There is weak statistical evidence of poor industrials factor timing by hedge funds – investors who follow hedge funds should either ignore this bet or treat it as a negative indicator.

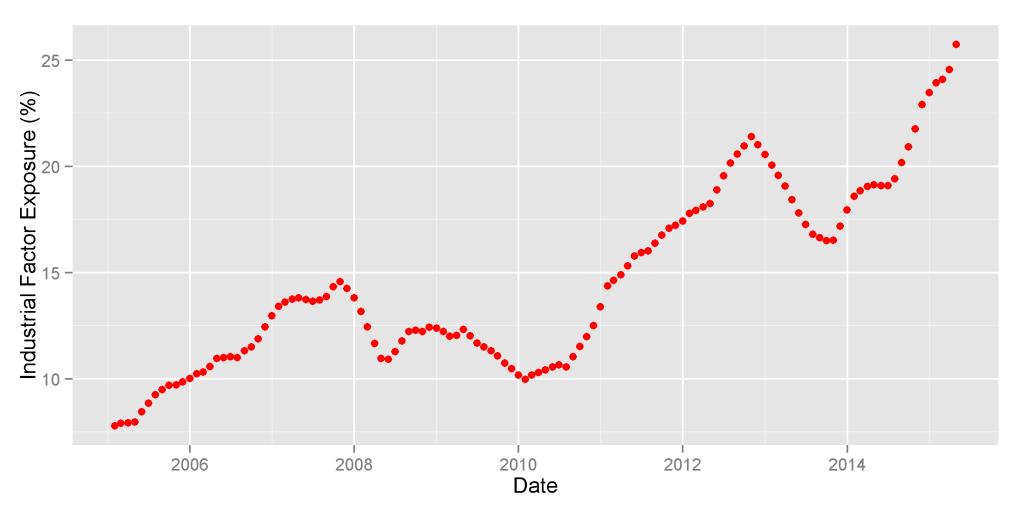

At the end of Q1 2015, high industrials sector factor exposure was the third largest source of U.S. hedge funds’ long portfolio crowding. HF Aggregate, a portfolio consisting of popular long U.S. equity holdings of all hedge funds tractable from quarterly filings, had over 25% industrials factor exposure – a 9% overweight relative to Market. This exposure was at an all-time high:

This industrials factor exposure captures sector risk after controlling for market exposure. For example, a fund with 10% allocated to a broad industrials index will have approximately 10% industrials factor exposure. A fund with 10% allocated to a 2x-levered broad industrials ETF will have approximately 20% industrials factor exposure.

Here we analyze the hedge fund industry’s skill in timing the U.S. Industrials Factor by varying this exposure. The AlphaBetaWorks Performance Analytics Platform evaluates market timing skills and performance using two related tests:

- Statistical test for the relationship between factor exposure and subsequent factor returns,

- Statistical test for the size and consistency of returns generated by varying factor exposures.

Hedge Fund Industrials Factor Exposure and Industrials Factor Return

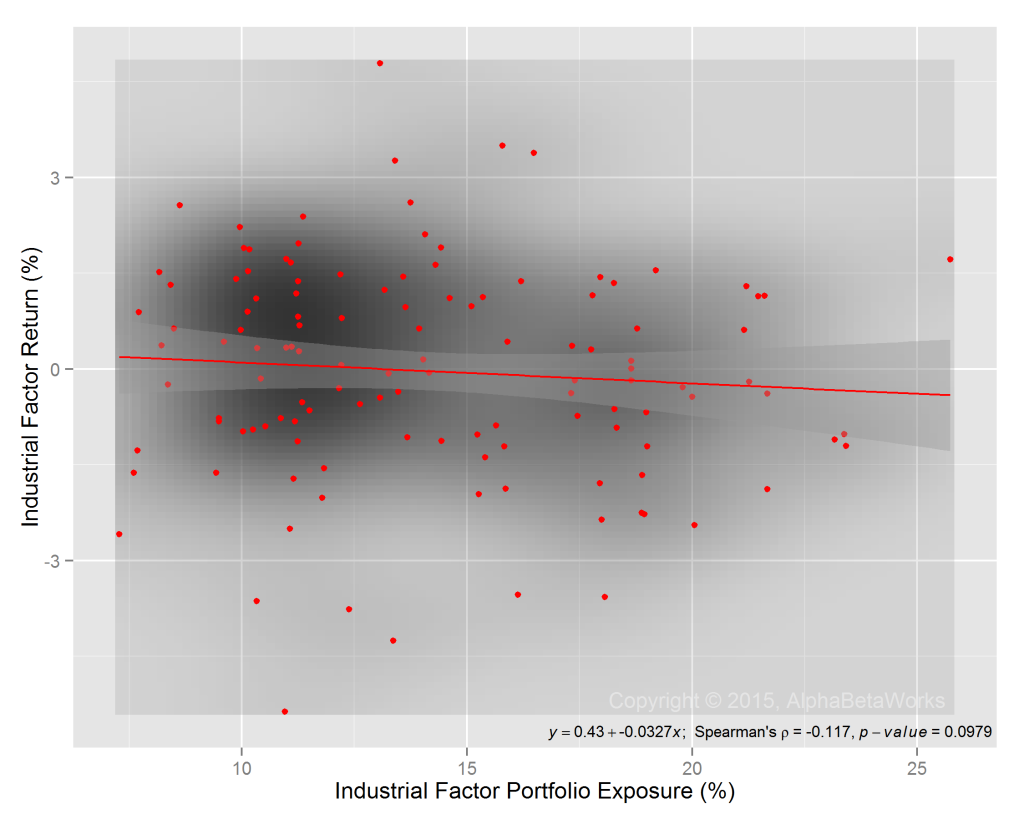

We calculated the Spearman’s rank correlation coefficient of HF Aggregate’s industrials factor exposure and subsequent industrials factor return for the past 10 years and tested it for significance. The chart below illustrates the correlation between the two series and the test results:

There is a statistically weak negative relationship between HF Aggregate’s industrials factor exposure and subsequent factor performance. Hedge fund industrials factor exposure is a weak predictor of future industrials returns.

Hedge Fund Industrials Factor Timing Returns

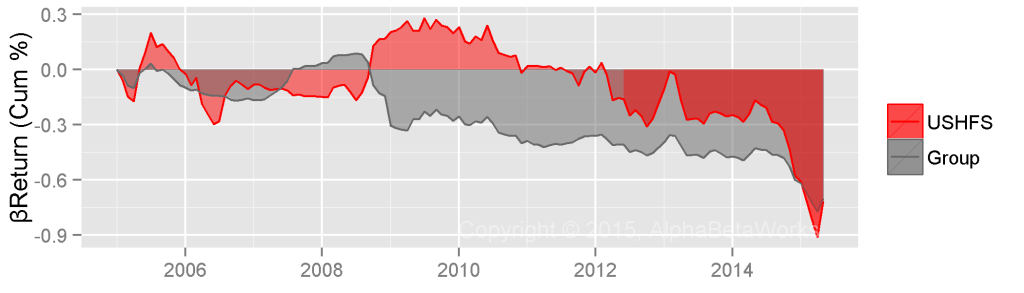

Over the past 10 years, HF Aggregate (USHFS in red) made approximately 0.9% less than it would have with constant industrials factor exposure, as illustrated below. The performance of HF Aggregate is compared to all tractable 13F filers (Group in gray). The AlphaBetaWorks Performance Analytics Platform identifies this performance due to industrials factor timing as industrials βReturn:

The weak evidence of poor industrials factor timing by the industry, combined with the high recent industrials factor exposure, is a weak bearish indicator for the sector.

Summary

- The industrials factor exposure of U.S. hedge funds’ long portfolios is weakly predictive of subsequent sector performance.

- Current hedge fund industrials factor exposure, at 10-year highs, is a weak bearish indicator for the Industrials Sector.

- Investors who track hedge fund holdings should either ignore this bet or treat is as a negative indicator.