Hedge funds tend to pile into the same few stocks. In most sectors these crowded bets underperform. In previous articles we discussed the crowding of hedge fund energy as well as exploration and production bets. Internet software stocks show similar underperformance.

Hedge Fund Internet Software Aggregate

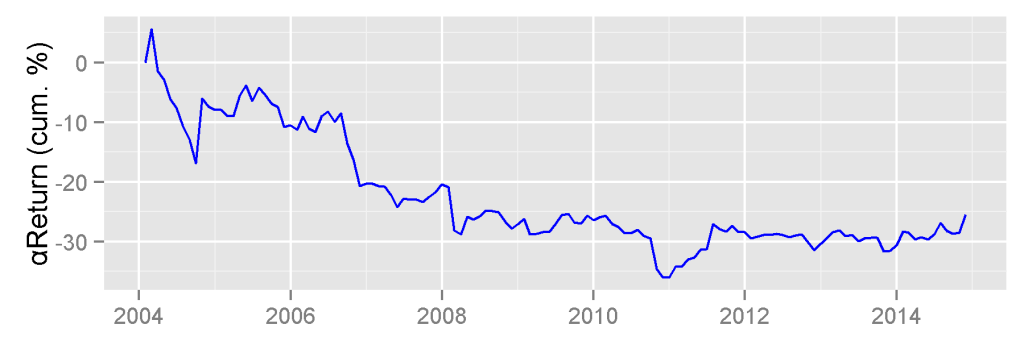

If markets were flat since 2004, the aggregate position-weighted hedge fund internet software portfolio (HF Aggregate) would have lost 25%. This is HF Aggregate’s risk adjust return from security selection (αReturn):

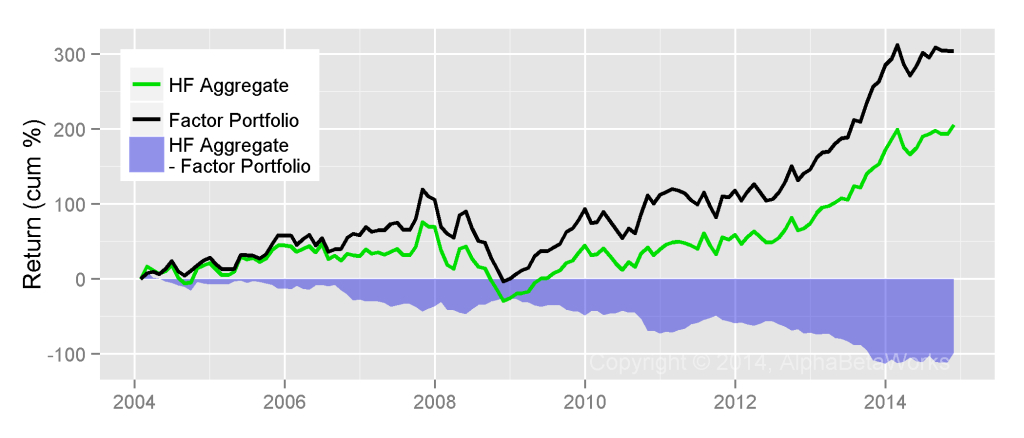

Given the compounding of αReturns and internet software sector returns, the cumulative underperformance is even larger: Since 2004 HF Aggregate returned 200%. A portfolio with the same systematic risk as HF Aggregate (Factor Portfolio) returned 300%. Investors in crowded bets missed out on 100% in gains:

Hedge Fund Internet Software Crowding History

The following video shows the history of crowded hedge fund internet software bets. These are the stocks behind the record:

Current Hedge Fund Internet Software Crowding

The following are the currently crowded hedge fund internet software bets. Just two (long EQIX, short/underweight GOOGL) are responsible for over three quarters of the risk of HF Internet Software Aggregate:

| Position (%) | |||||

| Symbol | Name | HF Aggregate | Market Aggregate | Relative | Share of Risk (%) |

| EQIX | Equinix, Inc. | 23.77 | 1.63 | 22.14 | 53.73 |

| GOOGL | Google Inc. Class A | 10.51 | 44.39 | -33.88 | 25.65 |

| TWTR | Twitter, Inc. | 0.49 | 3.46 | -2.97 | 4.65 |

| ZNGA | Zynga Inc. Class A | 2.89 | 0.26 | 2.63 | 3.52 |

| RBDC | RBID.com, Inc. | 0.00 | 0.17 | -0.17 | 2.07 |

| P | Pandora Media, Inc. | 2.41 | 0.53 | 1.88 | 1.87 |

| RAX | Rackspace Hosting, Inc. | 3.13 | 0.86 | 2.27 | 1.76 |

| SFLY | Shutterfly, Inc. | 2.32 | 0.22 | 2.10 | 1.38 |

| WBMD | WebMD Health Corp. | 1.84 | 0.18 | 1.66 | 0.93 |

| NERO | NeuroMama Ltd. | 0.00 | 0.74 | -0.74 | 0.75 |

| AKAM | Akamai Technologies, Inc. | 3.04 | 1.50 | 1.54 | 0.61 |

| TRLA | Trulia, Inc. | 1.01 | 0.25 | 0.76 | 0.36 |

| IACI | IAC/InterActiveCorp. | 2.83 | 0.66 | 2.16 | 0.34 |

| YNDX | Yandex NV Class A | 2.32 | 0.81 | 1.51 | 0.33 |

| MSTR | MicroStrategy Incorporated Class A | 1.54 | 0.20 | 1.34 | 0.31 |

| LNKD | LinkedIn Corporation Class A | 2.20 | 3.20 | -1.00 | 0.27 |

| FB | Facebook, Inc. Class A | 21.76 | 22.54 | -0.78 | 0.21 |

| MELI | MercadoLibre SA | 0.00 | 0.81 | -0.81 | 0.15 |

| KING | King Digital Entertainment Plc | 1.05 | 0.63 | 0.42 | 0.13 |

| ECOM | Channeladvisor Corporation | 0.42 | 0.06 | 0.37 | 0.11 |