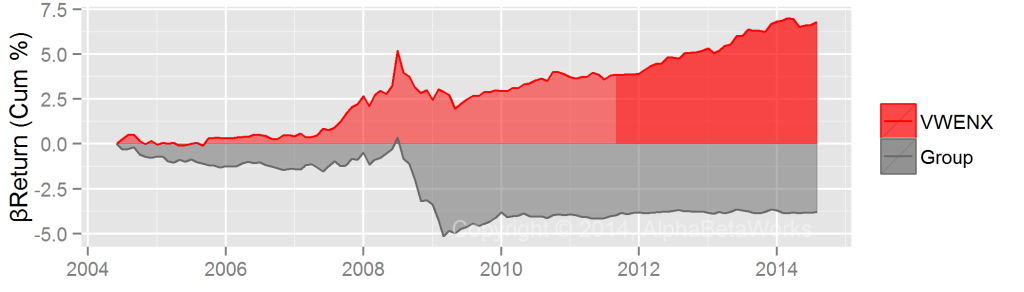

Vanguard Wellington Fund (VWENX) is an excellent market timer with a track record of increasing exposures to factors that subsequently generate larger-than-typical returns.

Over the past 10 years, the fund returned approximately 7% solely through varying its factor exposures. This compares to an approximately 4% market-timing loss for the average medium turnover U.S. equity mutual fund:

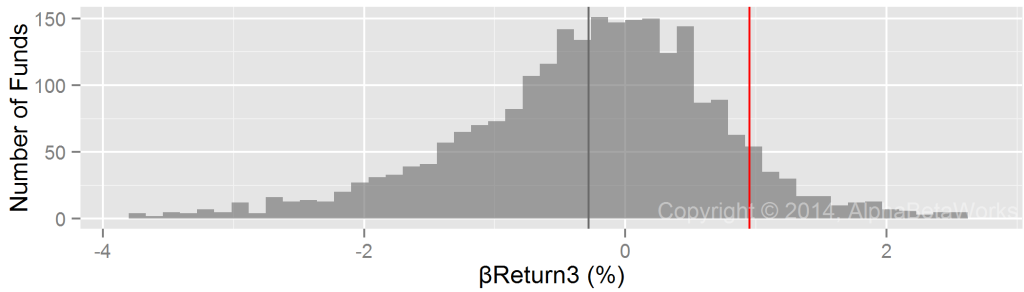

VWENX’s 3-year marker timing return (βReturn3) is well ahead of the group:

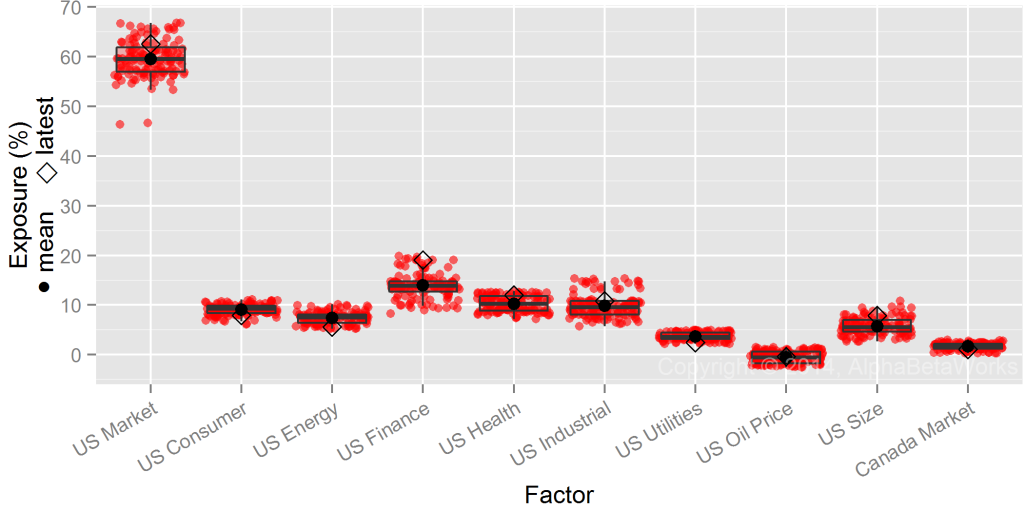

Given the excellent market-timing performance, VWENX’s bets are worth watching.

- The fund’s exposures to finance sector, health sector, and large-caps are larger than typical.

- The fund’s exposures to consumer sector, energy sector, and utilities are smaller than typical.