Should Investors Follow Icahn into Apple?

As we discussed in earlier articles, it is a mistake to treat all ideas of excellent managers with equal deference. Even great investors tend to be more skilled in some areas than in others. Carl Icahn is no exception.

Many investors follow the positions of Carl Icahn. His recent open letter to Apple’s CEO Tim Cook will cause some to follow Icahn into Apple. Doing so merely on the basis on Icahn’s involvement would be a mistake. While Icahn Associates generated spectacular long-term returns from security selection (stock-picking), the firm’s technology performance has been disappointing.

Icahn’s Overall Security Selection

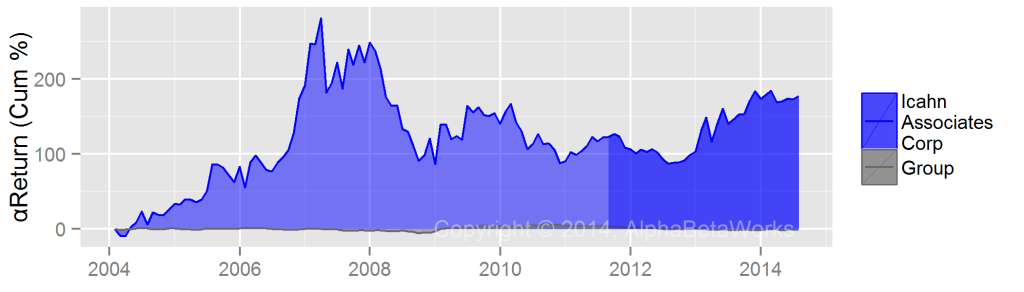

The risk-adjusted return of Icahn Associates’ long equity portfolio, estimated from the firm’s 13F filings, is indeed high. We estimate that over the past 10 years the firm generated over 150% cumulative return from long equity security selection. We call this αReturn – the estimated annual percentage return a fund would have generated in a flat market:

While Icahn Associates’ long-term record is strong, the inconsistent αReturn is a concern.

Icahn’s Technology Security Selection

We focus on Icahn’s skill vis-à-vis the technology sector only. In the future articles we will explore the sources of Icahn’s risk-adjusted returns in greater depth.

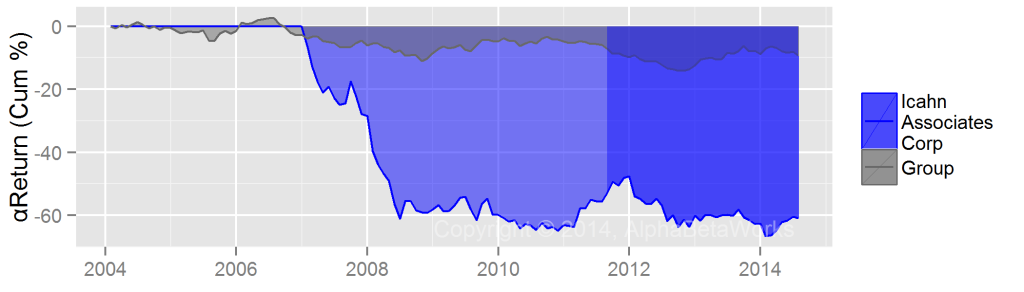

Icahn Associates’ long technology equity positions have lost approximately 60% on a risk-adjusted basis since 2004. The chart below shows the returns of Icahn’s technology portfolio relative to ETFs with the same market and technology factor exposures. Icahn’s picks have underperformed by 60%:

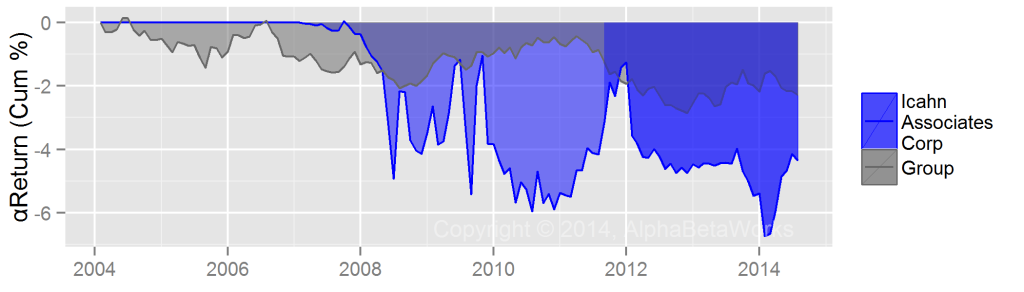

Technology stock picking cost the aggregate long equity portfolio approximately 4% over this period. If Icahn Associates had invested in a passive technology portfolio with matching systematic risk, the 10-year return would have been 4% higher.

It turns out that technology is one of Icahn’s areas of weakness. While AAPL may be an excellent investment on its own merits, investors should not make their decisions based on Icahn’s involvement. If anything, it’s a negative indicator.