Value Partners High Dividend Stocks Fund has excellent long-term security selection (stock picking) performance. Results are ahead of 2/3 of U.S. mutual funds. However, inconsistency of security selection returns is a concern.

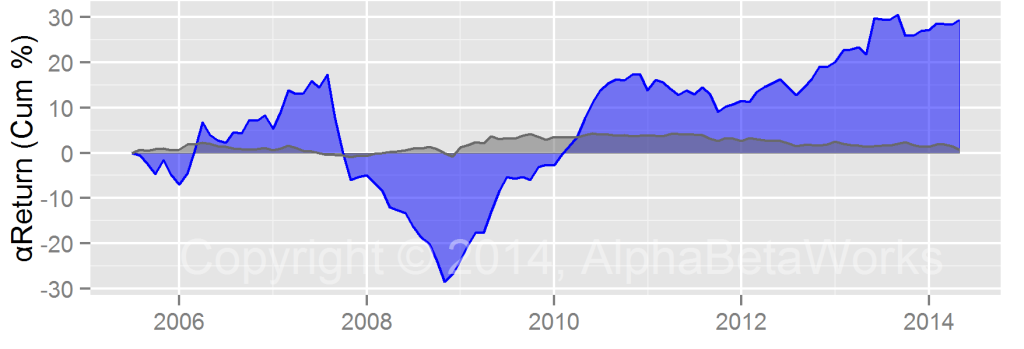

The fund generated approximately 3% annual gross return from security selection:

This is the residual return, or αReturn. It is the return in excess of the systematic performance due to the fund’s factor (market) bets. It is also the return a fund would have generated in a flat market.

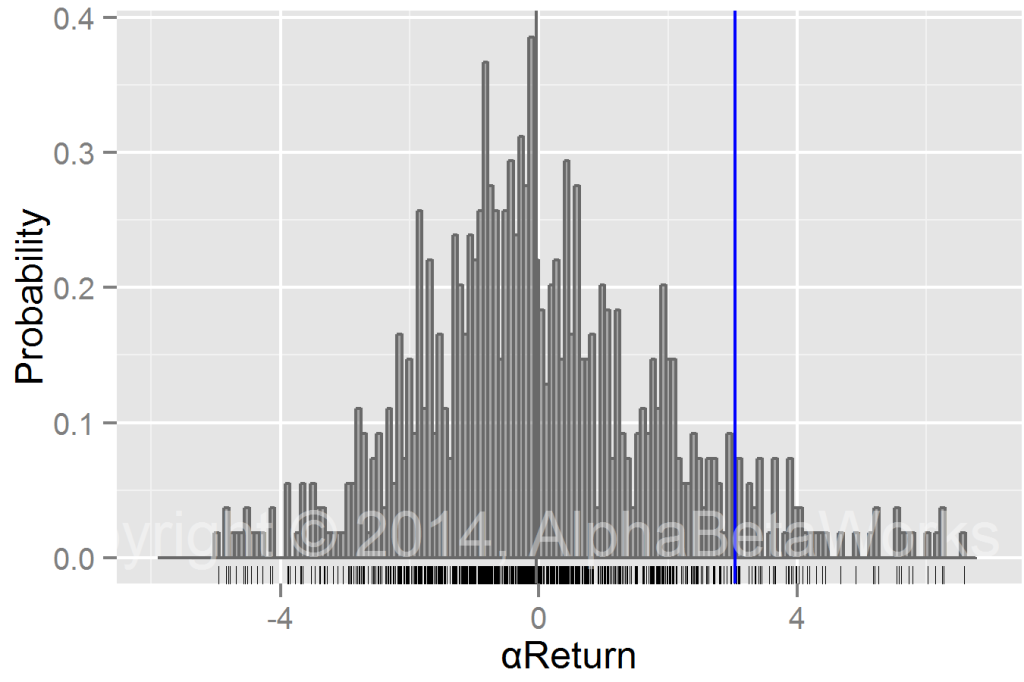

This compares favorably to U.S. mutual funds:

One major issue is inconsistency. The other is the expense ratio, eating up approximately 2/3 of the historical αReturn.