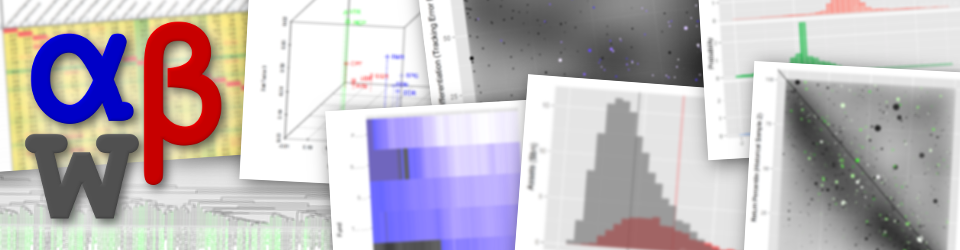

Artisan International Fund (ARTIX) and Artisan International Value Fund (ARTKX) – Security Selection

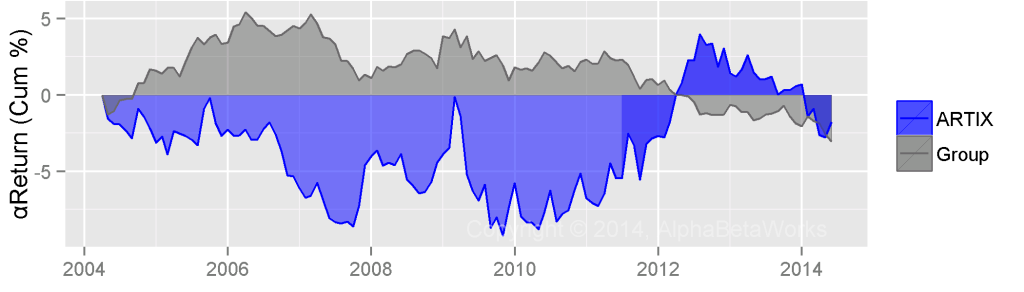

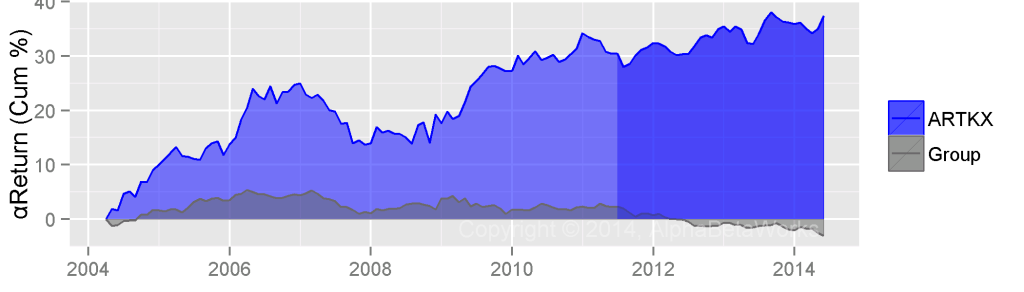

Both Artisan International Fund (ARTIX) and Artisan International Value Fund (ARTKX) show excellent security selection (stock picking) performance over the past 10 years.

If all markets were flat for the past 10 years, ARTIX would have generated approximately 0% cumulative return from stock picking. This is not bad: The average fund would have lost money, even with the massive survivor bias of the peer group (funds that have been around for 10 years):

The results of ARTKX are spectacular. It would have made over 35% if markets were flat – one of the best track records among domestic and international funds:

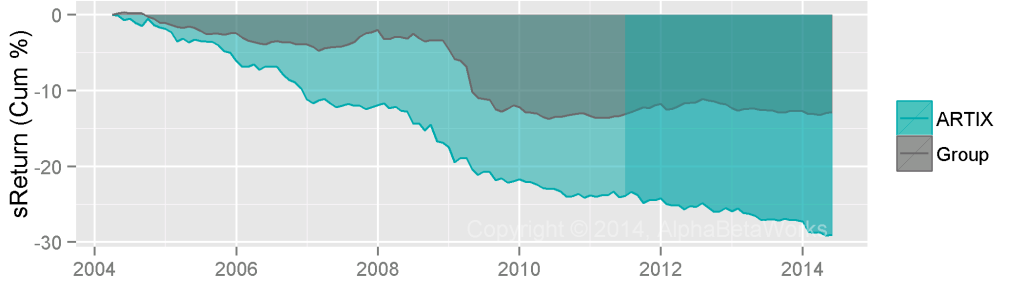

A word of caution: ARTIX shows signs of over-capitalization and position scalability issues. It lost approximately 30% over the past 10 years due to position sizing. Its largest positions were (consistently) its worst stock picks:

In summary: Stock picking skills of the flagship international funds appear strong, but their scalability is a concern.