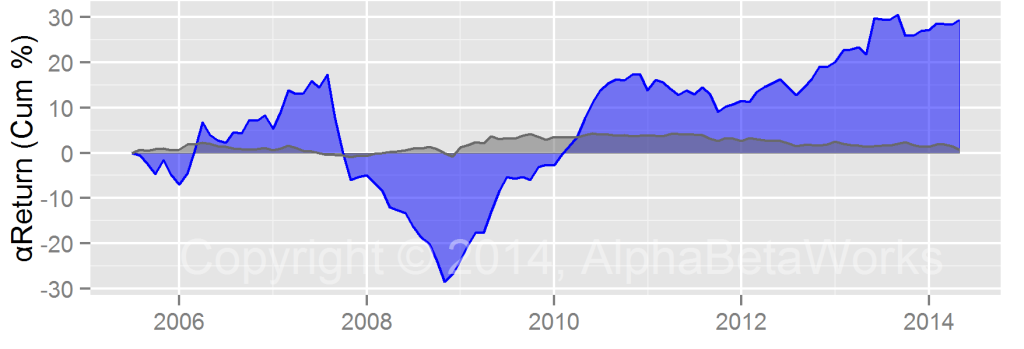

Fisher Asset Management Security Selection Return — 13F Portfolio

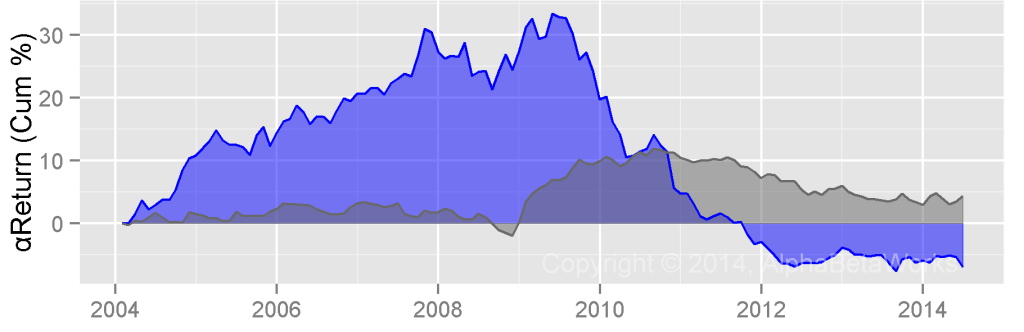

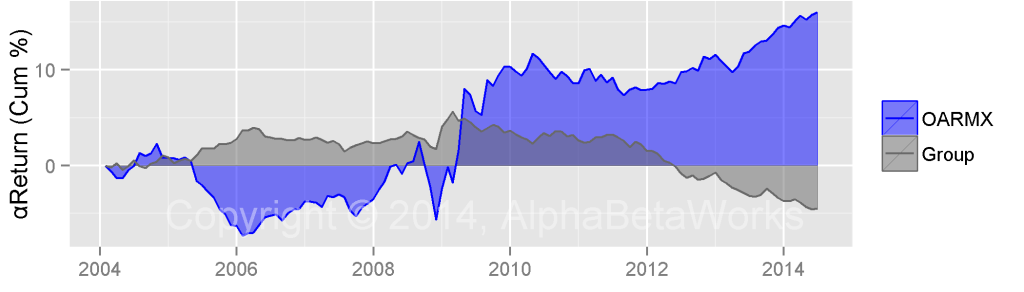

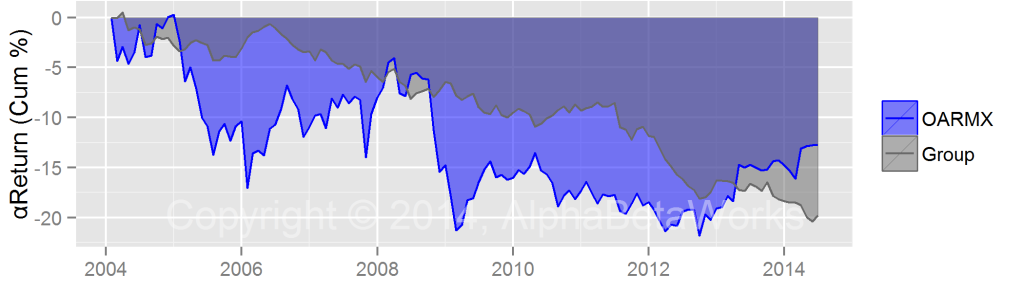

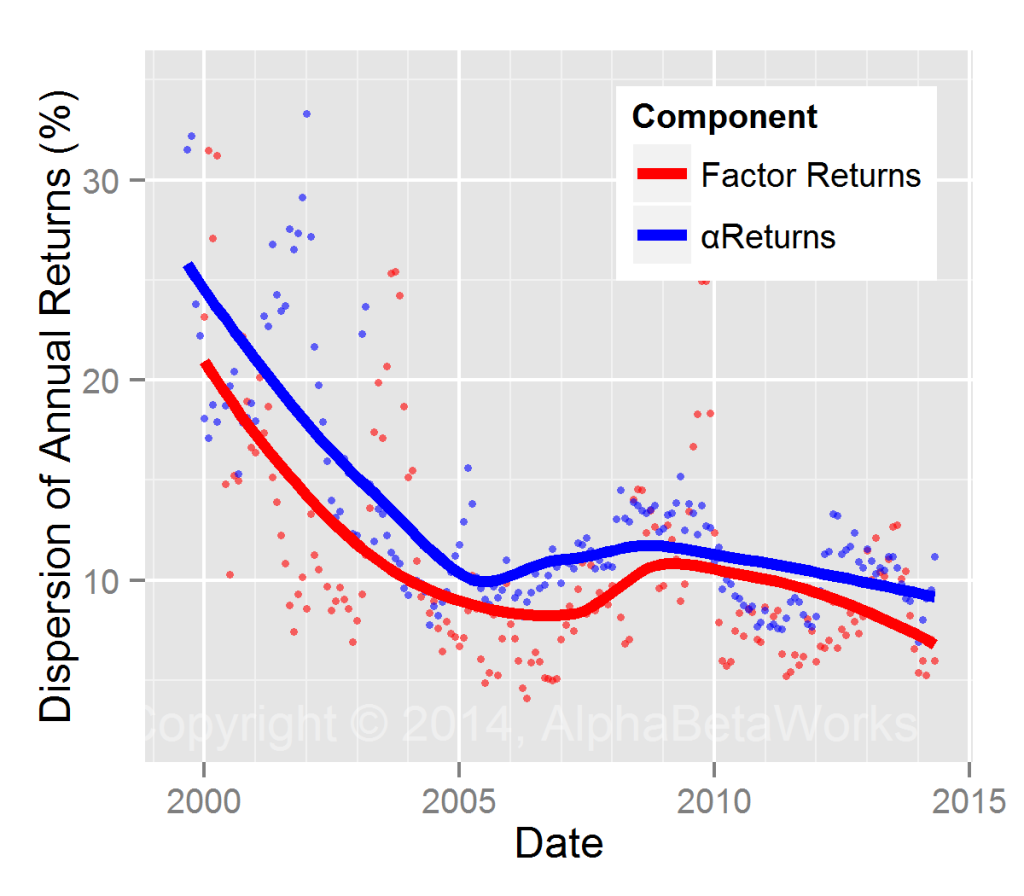

The following is a chart of Fisher Asset Management, LLC’s estimated security selection (stock picking) return for all long positions over the past 10 years:

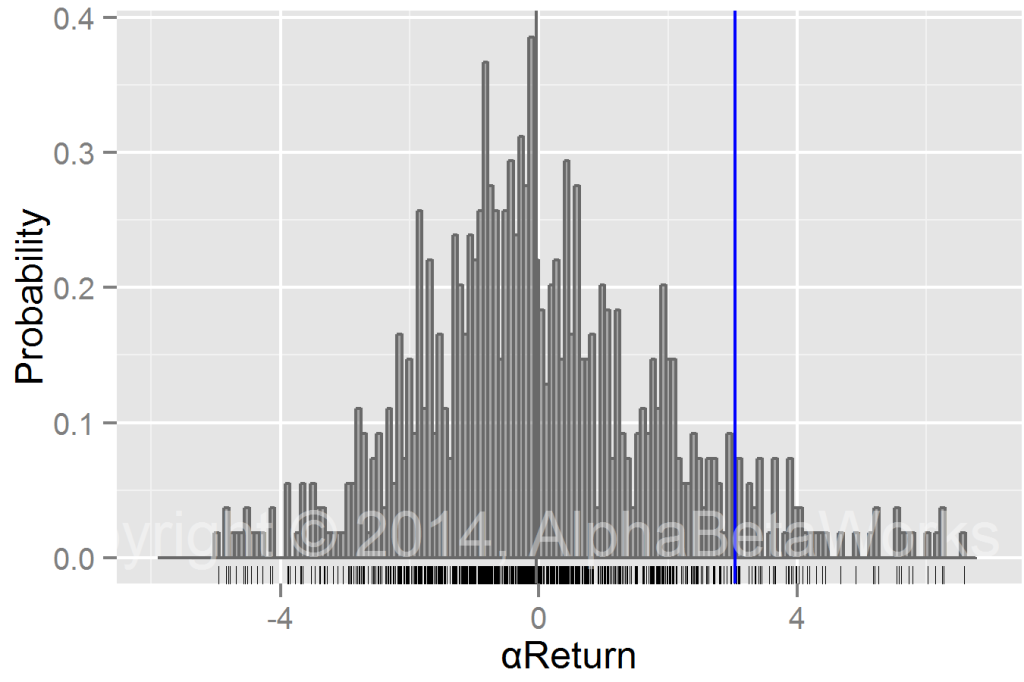

The analysis evaluated 10 years of 13F fling history for the firm. It estimated the returns the portfolio would have generated if markets were flat – stock picking performance independent of the market.