SanDisk (SNDK) was down 14% following a disappointing pre-announcement. This is a common occurrence for crowded ideas: SanDisk is the most crowded hedge fund bet in its sector, and crowded hedge fund Electronic Components picks tend to do poorly. These events illustrate crowding costs, particularly in the areas where hedge funds display a persistent lack of skill.

This piece analyzes hedge fund Electronic Components sector holdings (HF Sector Aggregate) relative to the sector market portfolio (Sector Aggregate). HF Sector Aggregate is position-weighted while Sector Aggregate is capitalization-weighted. We follow the approach of our earlier articles on aggregate and sector-specific hedge fund crowding. Crowded positions are vulnerable to volatility, mass liquidation, and losses. In some sectors crowded positions persistently underperform.

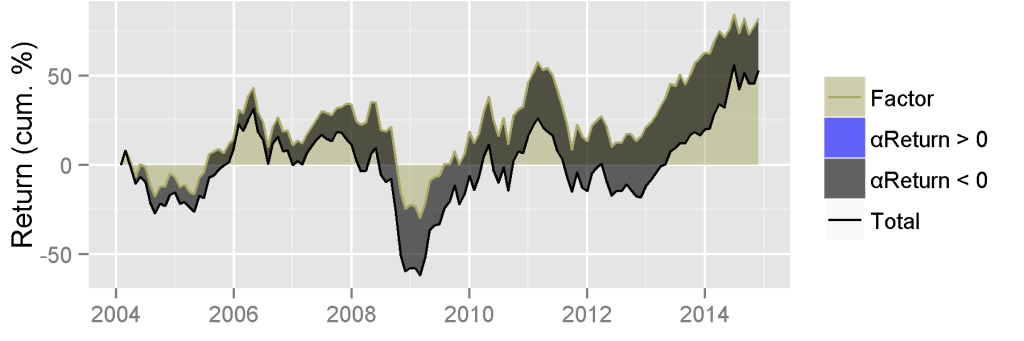

Hedge Fund Electronic Components Performance

The figure below plots historical return of HF Sector Aggregate. Factor return is due to systematic (market) risk. Blue area represents positive and gray area represents negative risk-adjusted returns from security selection (αReturn):

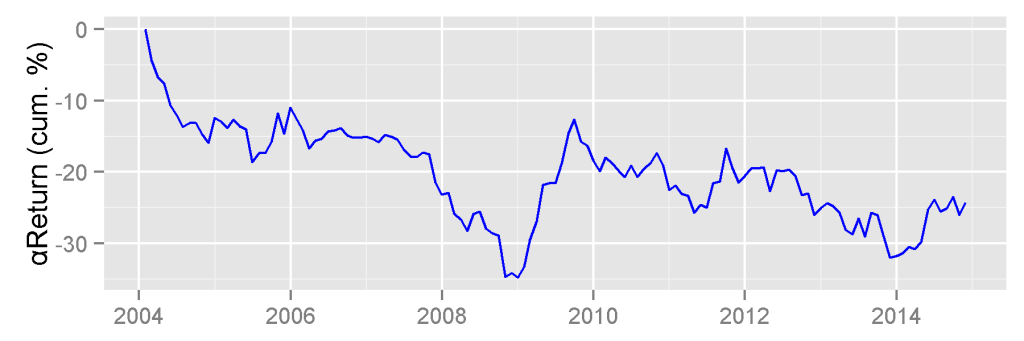

Hedge Fund Electronic Components Risk-Adjusted Performance

The risk-adjusted return from security selection (αReturn) of HF Sector Aggregate is the return it would have generated if markets were flat. This is the idiosyncratic performance of the crowded portfolio. Adjusted for market returns, crowded bets have lost 24% since 2004:

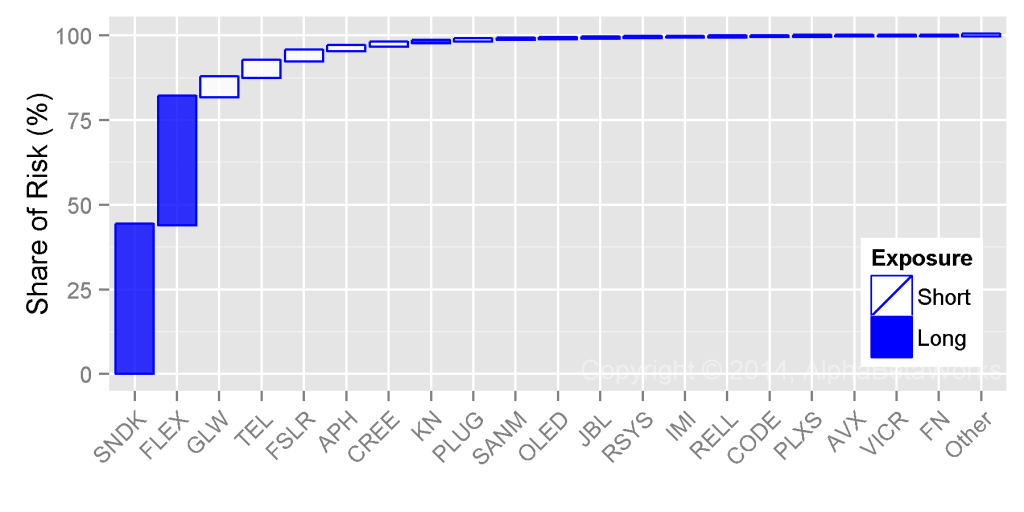

Crowded Hedge Fund Electronic Components Bets

The following stocks contributed most to the relative residual (security-specific) risk of the HF Sector Aggregate as of 2014-09-30. Blue bars represent long (overweight) exposures relative to Sector Aggregate. White bars represent short (underweight) exposures. Bar height represents contribution to relative stock-specific risk:

The following table contains detailed data on these crowded bets:

| Exposure (%) | Net Exposure | Share of Risk (%) | |||||

|---|---|---|---|---|---|---|---|

| HF Sector Aggr. | Sector Aggr. | % | $mil | Days of Trading | |||

| SNDK | SanDisk Corporation | 40.46 | 16.60 | 23.87 | 584.0 | 1.7 | 43.86 |

| FLEX | Flextronics International Ltd. | 35.31 | 4.59 | 30.73 | 751.9 | 13.7 | 37.92 |

| GLW | Corning Incorporated | 2.68 | 18.87 | -16.19 | -396.1 | -2.0 | 5.73 |

| TEL | TE Connectivity Ltd. | 0.02 | 17.10 | -17.07 | -417.9 | -3.0 | 4.84 |

| FSLR | First Solar, Inc. | 1.38 | 4.98 | -3.60 | -88.1 | -0.7 | 3.00 |

| APH | Amphenol Corporation Class A | 1.31 | 11.86 | -10.55 | -258.3 | -3.4 | 1.30 |

| CREE | Cree, Inc. | 0.82 | 3.70 | -2.88 | -70.5 | -0.8 | 1.02 |

| KN | Knowles Corp. | 3.51 | 1.70 | 1.81 | 44.3 | 1.1 | 0.58 |

| PLUG | Plug Power Inc. | 0.03 | 0.58 | -0.55 | -13.5 | -0.6 | 0.47 |

| SANM | Sanmina-SCI Corporation | 0.00 | 1.30 | -1.30 | -31.9 | -1.9 | 0.23 |

| OLED | Universal Display Corporation | 0.27 | 1.15 | -0.88 | -21.5 | -1.3 | 0.17 |

| JBL | Jabil Circuit, Inc. | 1.67 | 3.05 | -1.38 | -33.7 | -0.5 | 0.12 |

| RSYS | RadiSys Corporation | 0.75 | 0.07 | 0.67 | 16.5 | 60.7 | 0.11 |

| IMI | Intermolecular, Inc. | 0.91 | 0.08 | 0.82 | 20.1 | 145.2 | 0.10 |

| RELL | Richardson Electronics, Ltd. | 1.62 | 0.09 | 1.53 | 37.5 | 162.9 | 0.08 |

| CODE | Spansion Inc. Class A | 0.21 | 1.05 | -0.84 | -20.7 | -0.3 | 0.06 |

| PLXS | Plexus Corp. | 0.00 | 0.94 | -0.94 | -23.0 | -2.9 | 0.05 |

| AVX | AVX Corporation | 0.00 | 1.69 | -1.69 | -41.3 | -13.2 | 0.04 |

| VICR | Vicor Corporation | 0.70 | 0.19 | 0.51 | 12.5 | 9.9 | 0.04 |

| FN | Fabrinet | 0.00 | 0.39 | -0.39 | -9.5 | -2.8 | 0.04 |

| … | Other Positions | 0.19 | 0.23 | ||||

| Total | 100.00 | ||||||

Conclusion

SanDisk illustrates the vulnerability to crowded names to mass liquidation by impatient investors. In general, crowded Electronic Component stocks tend to disappoint and hedge funds do even worse in other sectors.

Instead of blindly following hedge funds into popular technology names, investors should be wary of these ideas. Even excellent managers are seldom skilled in all areas and tend to generate the bulk of their active returns from a few specific skills.