Our earlier work showed that nominal returns and related simplistic performance metrics are dominated by market noise and hence revert. The reversion means that yesterday’s best-performing managers tend to be tomorrow’s worst. Yet, once distilled from systematic noise, stock picking skill is evident. This piece measures the decay of stock picking performance over time and identifies the historical window most predictive of future performance. We demonstrate that superior manager selection requires spotting skill well before the crowd arbitrages it away.

Measuring the Decay of Stock Picking Skill

This study analyzes portfolios of all institutions that have filed Form 13F. This is the broadest and most representative survivorship-free portfolio database covering thousands of firms that hold at least $100 million or more in U.S. long assets. Approximately 5,000 firms had sufficiently long histories, low turnover, and broad portfolios suitable for skill evaluation.

To measure the decay of stock picking performance over time, we compare metrics measured in two 12-month periods separated by variable delay. One example of 24-month delay is metrics for 1/31/2010-1/31/2011 and 1/31/2013-1/31/2014. We use Spearman’s rank correlation coefficient to calculate statistically robust correlations.

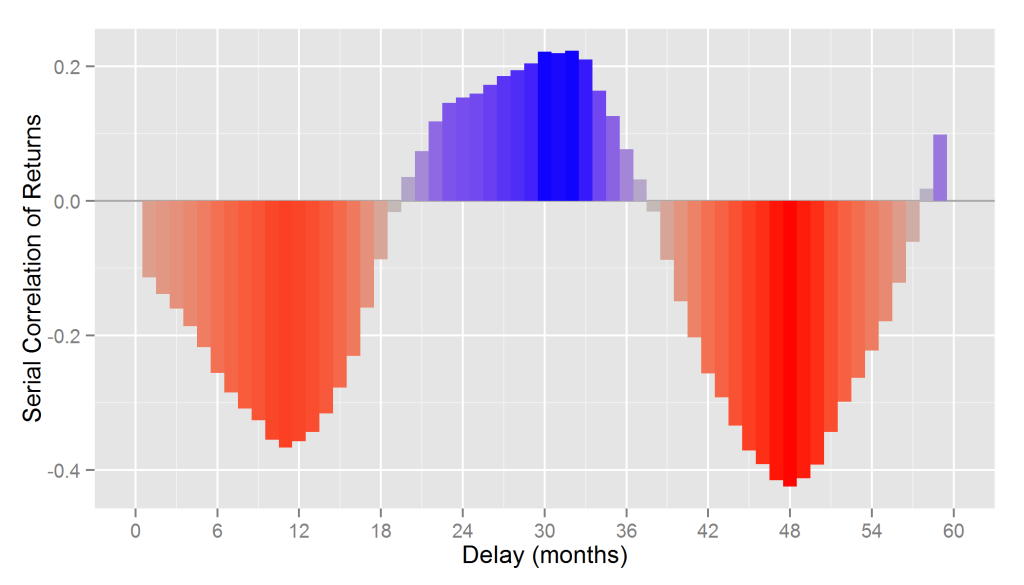

Serial Correlation of Nominal Returns

The following chart shows serial correlation (autocorrelation) between 12-month cumulative nominal returns calculated with lags of one to sixty months (1-60 month lag). The relationship is generally negative. This illustrates that strong past (nominal) returns are predictive of future returns, albeit poor in the short-term:

| Delay (months) | Serial Correlation |

| 1 | -0.11 |

| 6 | -0.26 |

| 12 | -0.36 |

| 18 | -0.09 |

| 24 | 0.15 |

| 30 | 0.22 |

| 36 | 0.08 |

| 42 | -0.26 |

| 48 | -0.42 |

| 54 | -0.22 |

| 60 | 0.17 |

There is a narrow window at 2-3 year lag when past returns are predictive of the future results. This appears to be due to the approximately 18-month cycle of reversion in 12-month nominal performance.

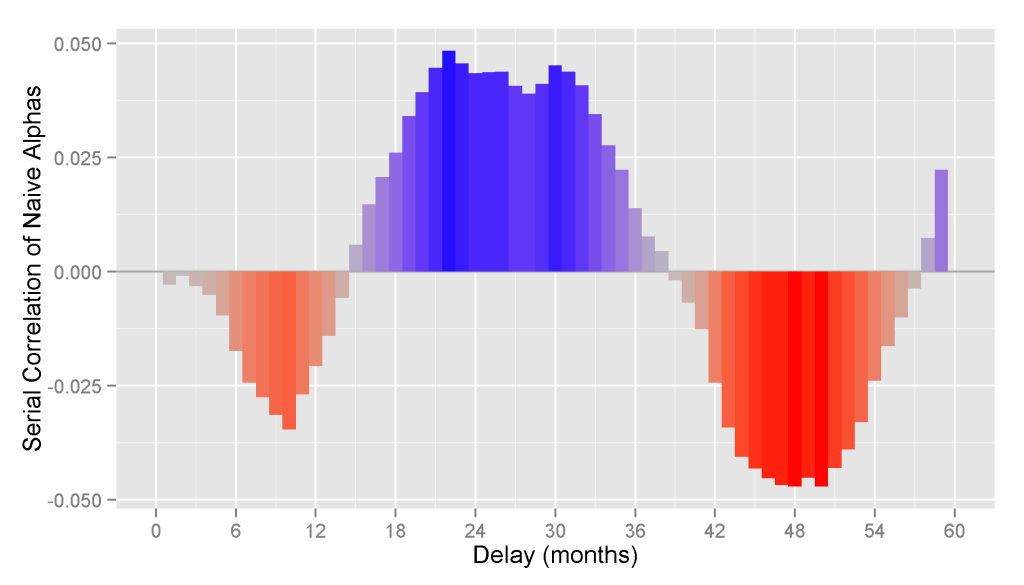

Serial Correlation of Naive Alphas

It is common to measure alpha simply as outperformance relative to a benchmark. We will call this approach “naive alpha.” Since it ignores portfolio risk, this approach does not eliminate systematic (factor) effects and fails to isolate security selection performance: The top nominal performers who took the most systematic risk in a bullish regime remain the top performers after a benchmark return is subtracted. When regimes change, these former leaders tend to become the laggards, and vice versa.

Indeed, the serial correlation of naive alphas is similar to the serial correlation of nominal returns. The following chart shows correlation between 12-month cumulative naive alphas calculated with 1-60 month lags:

| Delay (months) | Serial Correlation |

| 1 | 0.00 |

| 6 | -0.02 |

| 12 | -0.02 |

| 18 | 0.03 |

| 24 | 0.04 |

| 30 | 0.05 |

| 36 | 0.01 |

| 42 | -0.02 |

| 48 | -0.05 |

| 54 | -0.02 |

| 60 | 0.04 |

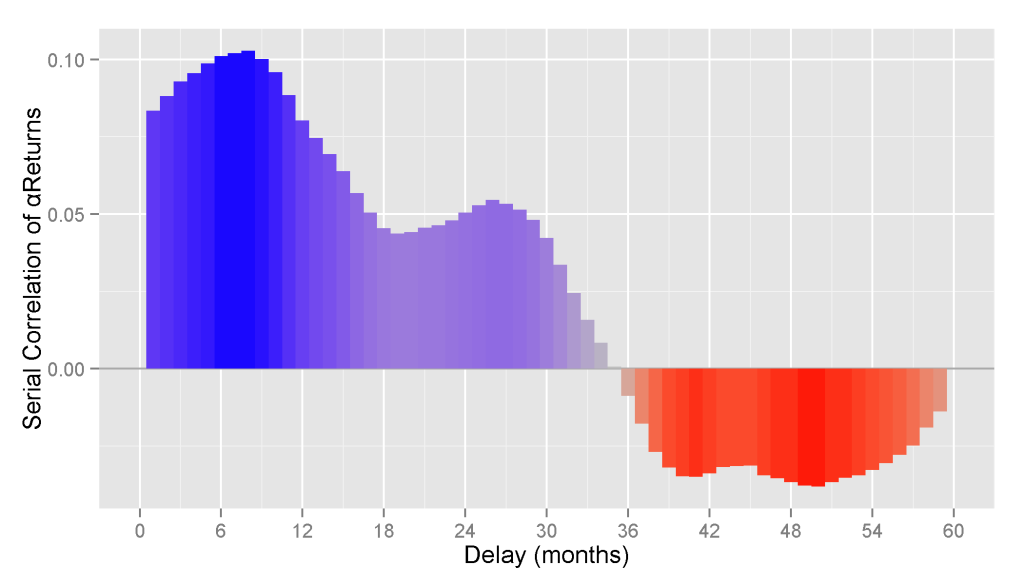

Serial Correlation of Security Selection Returns

To eliminate the disruptive factor effects responsible for performance reversion, the AlphaBetaWorks Performance Analytics Platform calculates each portfolio’s return from security selection net of factor effects. αReturn is the return a portfolio would have generated if all factor returns had been flat.

Firms with above-average αReturns in one period are likely to maintain them in the other, but with decay. The following chart shows correlation between 12-month cumulative αReturns calculated with 1-60 month lags:

13F Equity Portfolios: Serial correlation of αReturns (risk-adjusted returns from security selection)

| Delay (months) | Serial Correlation |

| 1 | 0.08 |

| 6 | 0.10 |

| 12 | 0.08 |

| 18 | 0.05 |

| 24 | 0.05 |

| 30 | 0.04 |

| 36 | -0.01 |

| 42 | -0.03 |

| 48 | -0.04 |

| 54 | -0.03 |

| 60 | -0.01 |

Though the above serial correlations of αReturn may appear low, they are amplified and compounded in practical portfolios of multiple funds. A hedged portfolio of the net consensus longs (relative overweights) of the top 5% long U.S. equity stock pickers delivered approximately 8% return independently of the market.

For approximately 3 years, strong security selection performance, as measured by the 12-month αReturn, is predictive of the future 12-month results. Returns due to security selection thus persist for approximately 5 years. This means that as little as 12 month of consistently positive αReturns are a positive indicator for the following four years. Skilled stock pickers can be spotted years before their skill is plainly visible and broadly exploited.

The decay in security selection performance is typically due to the following sources: talent turnover, style drift, management distraction, and asset growth. It is not a coincidence that the conventional requirement for large institutional allocation is 3-5 year track record.

The above data is aggregate. Specific outstanding disciplined firms can overcome this reversion, but they are the exceptions that require careful monitoring. Spotting skilled managers before their skill is visible to all is a sounder path to superior selection. In this respect, investing with managers is very similar to investing in stocks. Manager skill is arbitraged away – analytical advantage over the crowd is key. Cheerful consensus is usually a recipe for mediocrity whether investing in a stock or in a fund.

Summary

- Nominal returns and related simplistic metrics of investment skill revert rapidly.

- Security selection returns persist for approximately 5 years.

- Selection of superior future performers is possible, but it requires spotting skill long before it is plainly visible and arbitraged away.