Paulson & Co Energy Sector Security Selection Skill

One should be careful when handling Paulson’s energy picks.

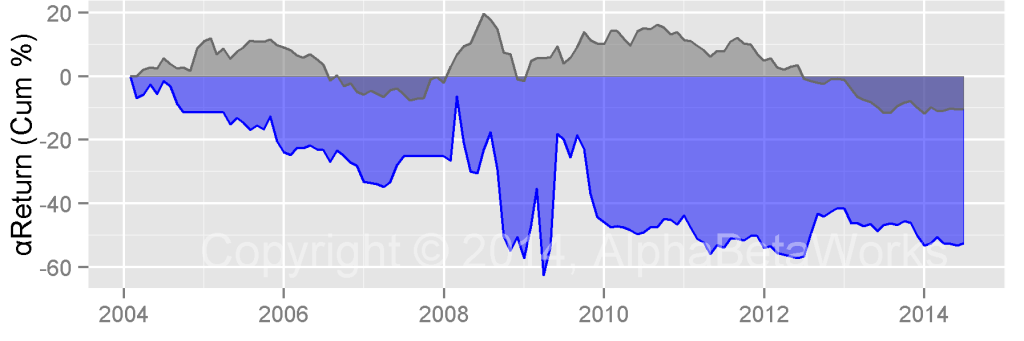

A portfolio of Paulson’s long (13F) energy positions has lost ~50% on a risk-adjusted basis. ETFs with the same market and energy sector exposures as the energy portfolio have outperformed it. The historical security selection (stock picking) performance of Paulson’s 13F positions is the blue αReturn on the following chart:

The energy sector stock picking has stabilized of late, but there is probably a stronger case for going short these positions, than long.